Introduction

When we think of what makes Japan unique in terms of SaaS and overall IT adoption, SI-ers come to mind. SI-ers are an indispensable part of corporate Japan when it comes to software adoption and IT strategies, which is why SaaS startups expanding to Japan ought to consider partnerships with these SI-ers to succeed.

SI-ers and their Dominance in Corporate Japan

System Integrators – or ‘SI-ers’ as they are abbreviated in the domestic Japanese vernacular – are a mainstay in corporate Japan when it comes to technological adoption. This is because they act as the go-to vendors/consultants for Japanese corporates to develop IT strategies and create solutions for corporate systems, especially for enterprise clients. As a benchmark to comprehend their scale, the total revenue of SI-ers is estimated to be JPY 8tn ($59bn), which is 80 times that of SaaS revenue hovering at JPY 100bn ($0.74bn) (*1).

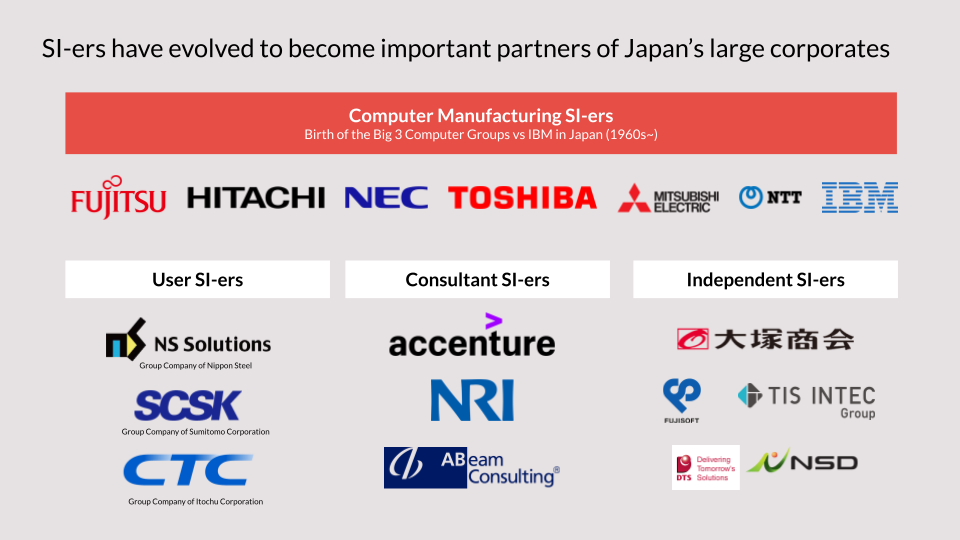

How did SI-ers amass such power and leverage in the first place? In the 1960s, in order to secure domestic competitiveness against IBM’s growing technological influence, the Japanese government consolidated the top 6 IT companies at that time to form the “Big 3 Computer Groups”: comprising Fujitsu+Hitachi, NEC+Toshiba, and Mitsubishi Electric+Oki, in addition to NTT, a powerful national entity at that time.

These computer groups received large swaths of funding and projects from the Japanese government over the next decades; such a policy priority in turn allowed the computer groups to grow and spin out multiple subsidiaries that specialize in developing IT solutions for the respective projects. Most of these groups grew in scale over the years, and eventually came to constitute the major SI-ers we now refer to as “Computer Manufacturing SI-ers”.

Over the same period of time, other types of SI-ers also emerged; these include: i) “User SI-ers”, which are IT-focused spin-offs from their parent companies (often not directly related to IT), ii) “Consultant SI-ers” which are consultancies that developed a specialization in IT strategy, and iii) “Independent SI-ers”, who are independent, domestic IT vendors that provide a broad range of IT-related services, from software to hardware as well. While all of these SI-ers may have had different origins, they generally provide similar services, that is, provide IT strategy consulting and system solutions for Japanese corporates.

The Value Chain of SI-ers and their Relationship with Corporates

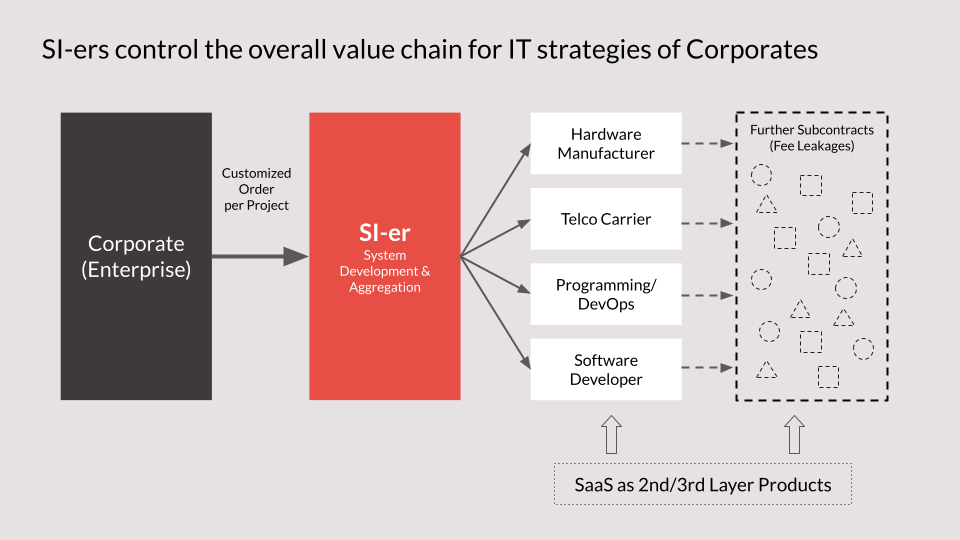

How do SI-ers work? Essentially SI-ers act as the conduit for all IT-related needs of Japanese corporates. When a corporate client requires an IT solution to, for instance, improve its daily operations, they send a customized order to their affiliated SI-er on a project basis. While SI-ers generally have in-house capabilities to provide these IT solutions, more complex projects with various needs would be outsourced to a 2nd layer of IT vendor specialists, such as those with specific know-how in hardware manufacturing or software development, amongst others.

Depending on the complexity of the project, there may even be subsequent 3rd or more layers of outsourcing. Within this value chain, the SI-er’s main responsibility is to coordinate and consolidate all of these moving parts, and integrate them into a coherent, functional system as per their corporate client’s request. Within this backdrop, SaaS products more often than not find themselves rather as 2nd/3rd layer products – not standalone solutions, but as components to ultimately be rolled up alongside other products, into the customized solution for the client.

The oligopolistic position of SI-ers causes critical dependencies to accrue on the side corporates over time as well, not only in terms of knowledge accumulation, but ultimately the ability to come up with IT strategy independently as well. According to a 2021 survey(*2)which asked Japanese corporates if they could continue business operations if SI-ers one day stopped providing them services, over 62% replied that SI-ers are an absolute must; without them, their businesses would invariably suffer long-term or even permanent loss. Not only are the initial development of the IT solutions outsourced, but subsequently, due to the lack of in-house IT knowledge accumulation, the continued operations and management of these databases and systems become increasingly dependent on SI-ers as well.

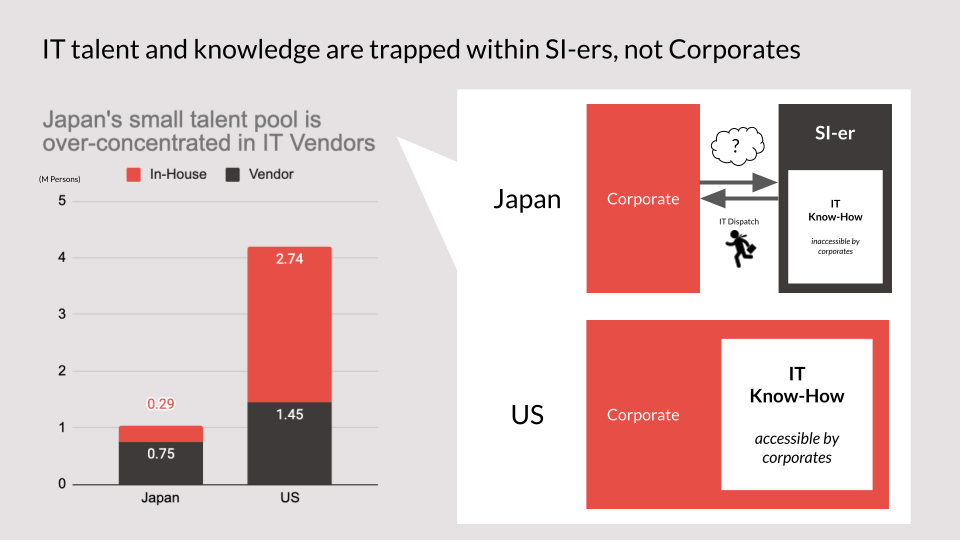

As a result, over the long-term, as we are witnessing unfolding in present-day Japan, IT talent has become saturated almost exclusively within SI-ers, rather than across corporates in-house. According to the Japanese Government’s 2018 White Paper on Information and Communication(*3), over 72% or 0.75 million people of IT talent in Japan belong to IT vendors/SI-ers; this ratio is the opposite of US, where only 35% or 1.45 million people (of a larger pool) belong to IT vendors/SI-ers.

What began as mere project-based outsourcing of IT system integration solutions eventually caused dependencies for management and strategy, and ultimately, as we can see, a large opportunity cost incurred in terms of developing IT talent and expertise in-house. This talent accumulation on the side of SI-ers is the reason why SI-ers remain undisrupted and maintain such a strong position of leverage over corporates as well as emerging SaaS startups trying to provide new software solutions.

SaaS Sales and Partnerships with SI-ers

Within this context of SI-ers and their influence in corporate Japan, how and should SaaS position themselves to ensure they can succeed? Simply put, the answer would be to partner up with the SI-ers to access and scale within their established sales network and processes.

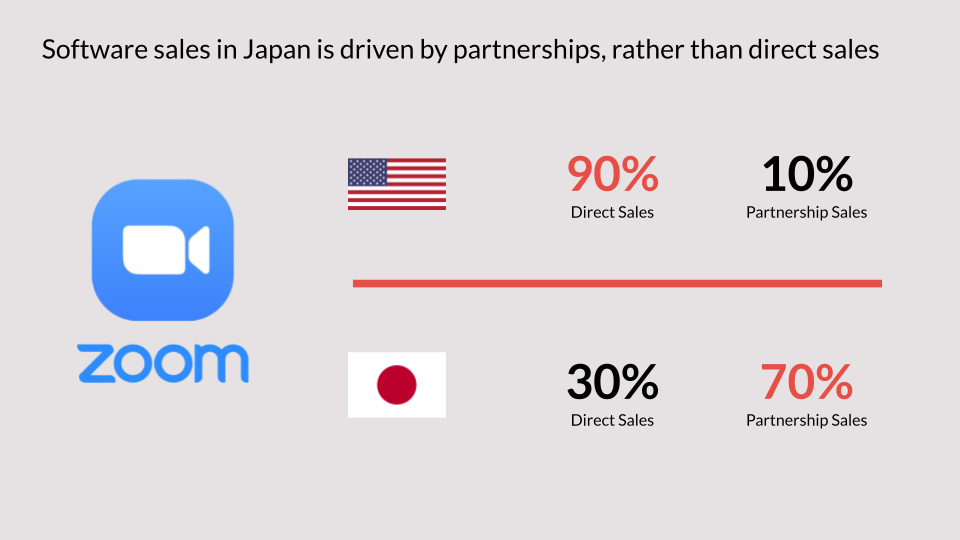

This is due to the different sales behavior that arose as a result of the aforementioned dependencies on SI-ers that corporates developed over the years. When we look at Zoom’s sales in the US, we see that 90% was derived from direct sales; however, in Japan, the converse is true, with most of Zoom’s sales derived from partnership sales at 70%(*4).

Undoubtedly, SI-ers may appear to be a relic of the past, where they deploy legacy systems despite more optimal solutions existing. However, as the least of all evils, partnership with them would prove to be the most optimal decision, even for domestic fledging Japanese SaaS startups, much less for global SaaS startups with little to no prior connections in Japan, considering that these SI-ers hold the largest economies of scale within the IT ecosystem.

Not only do they act as the de facto gatekeepers to corporate and enterprise sales, but also as the final arbiter of which products should or should not be rolled-up into the final packaged IT recommendation for their clients. In some sense, SaaS startups should imagine that they are first selling their partnerships to these SI-ers, in order to get priority within the product roll-up, and then access to the vast networks of corporate Japan.

Conclusion

Will this situation change in the near future? Perhaps, but it is unlikely. First and foremost, insofar as the asymmetric power relations and bargaining positions persist amongst corporates SI-ers and outsourced products (including SaaS startups), the flow of IT talent, that is, the ability for corporates to bypass SI-ers and make sound judgements on IT procurement, management and strategy will continue to be greatly limited.

Furthermore, even if we assume the situation loosens as IT literacy improves across the board, a more nuanced cultural point remains – many corporates still pride their company’s needs as unique, and therefore prefer a customized service according to their specific requirements (even though their pain could in all frankness be resolved with, for instance, a pure horizontal SaaS relational database with DIY API integrations).

All in all, even in optimistic scenarios, we still see that SI-ers will continue to play a major role in the distribution of IT solutions, of which SaaS is one of many possible product types; as such, be it a Japanese or global SaaS startup looking to expand and accelerate sales in Japan, SI-er partnerships look like the most optimal way forward.

*1 Salesforce Japan, “Why do SIers pose a challenge to developing SaaS apps?”, 19 Nov 2020

*2 IT Media, “62.6% of companies seeking digitalization say that SI-ers are still indispensable”, 12 April 2021

*3 ibid.

*4 Akio Hayafune, “10 Questions to ask for SaaS Partnership Strategies”, 31 March 2022

By Jorel Chan | FIRSTLIGHT Capital, Inc. Associate

2022.07.04

Here at FIRSTLIGHT Capital, we regularly deliver useful content on both Japanese and global startup trends, as well as hands-on experience from our very own venture capitalists and specialists. Please feel free to contact us via the CONTACT page if you would like to be in touch. Click here to follow FIRSTLIGHT Capital’s SNS account!