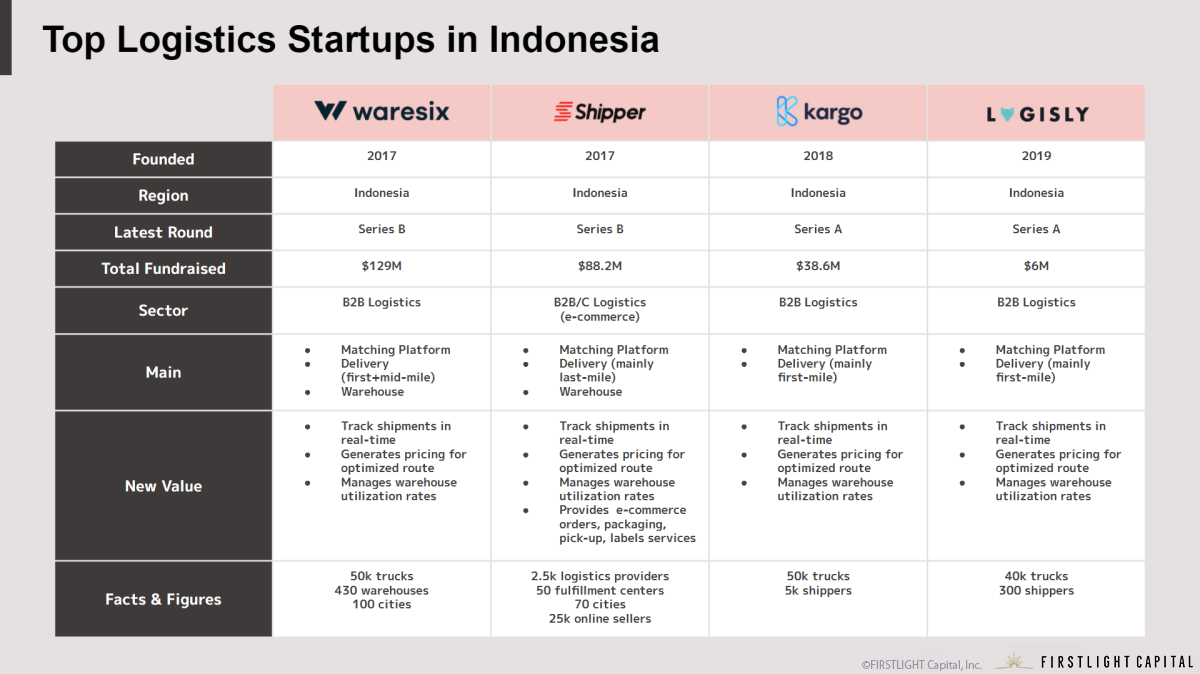

Logistics remains a very important industry for all countries in South-east Asia, situated at the heart of the maritime Silk Road. In this article, we will analyze 3 common growth strategies of 4 high-growth logistics startups in Indonesia: top-tier startups Waresix and Shipper, as well as rapidly emerging startups Kargo and Logisly.

It is interesting because we see that the growth patterns of the top logistics SaaS startups in Indonesia resemble each other to a large extent, and we will have a look at 3 lessons we can learn from them in terms of how logistics SaaS presents opportunities in Indonesia: 1) Generate new value with shared information flows, 2) Offer full-suite services through synergistic adjacencies, 3) Pursue acquisitions and partnerships after sufficient scale.

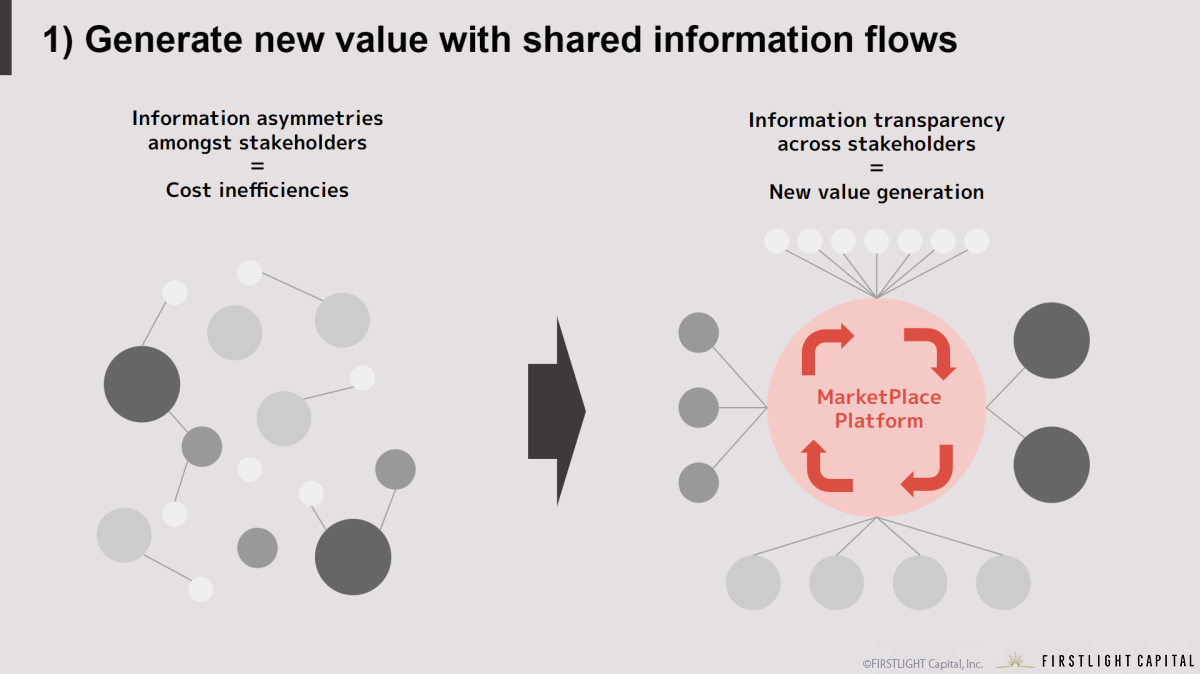

Generate New Value with Shared Information Flows

The fundamental challenge of logistics in SEA, especially in Indonesia in this case, is the fragmentation of information amongst players across the supply chain. This is due chiefly to geographical and commercial reasons.

With more than 17,500 islands, 6,000 of which are inhabited, even large B2B freight and trucking fleet managers are unable to cover the nation themselves – and have to use proprietary means to find small local partners to fulfill locations where infrastructure is unavailable.

Even in the B2C e-commerce space, compared to the US or many other countries where Amazon dominates, e-commerce in Indonesia is done via multiple fragmented platforms, like Tokopedia, Shopee, Bukalapak and Lazada; even smaller and individual vendors also sell and communicate orders status with their respective customers through Facebook, Instagram, WhatsApp and other social media.

Fragmentation of the supply chain means that there exists information asymmetries at every point of the delivery, from first-mile freight services (shipper to trucker) to last-mile courier services (business to consumer), for instance, optimizing capacity of truck fleets with the availability of warehouse space at any point in time via better data visibility. This presents itself as an opportunity for startups to position themselves, not only as a matching platform between stakeholders, but also as a facilitator of information.

This is the key approach that almost all successful logistic startups in SEA have taken, regardless of their target audience: Waresix, Shipper, Kargo and Logsily not only matches different stakeholders (businesses to warehouses, shippers to truckers etc.), but they also provide technology-based features like predictive pricing based on delivery routes and warehouse capacities.

It is these solutions on top of basic matching platforms capabilities that has generated new value for each stakeholder and made these successful scale successfully. No matter what audience they targeted, the principal goal was to consolidate the fragmented options available so that businesses could find the best price, transporters could maximize capacity utilization, and consumers would enjoy the fastest deliveries – tackling and optimizing every point of the supply chain, providing long-term cost efficiencies and win-win situations for every single stakeholder.

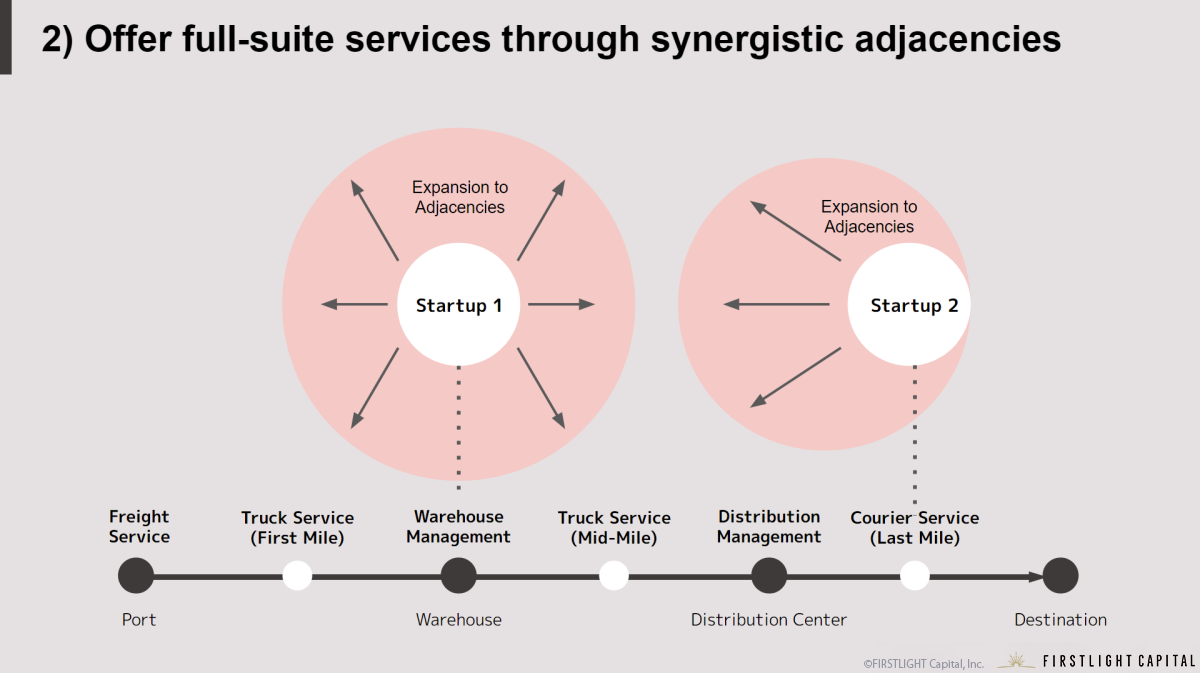

Offer Full-Suite Services Through Synergistic Adjacencies

The fragmented supply chain in SEA also provides the bedrock for future business expansion strategies for startups – across adjacencies. Not only are the opportunities to consolidate each point on the supply chain, but in the mid to long-term when a startup achieves sufficient scale, they can expand along the supply chain across adjacencies.

By expanding to these adjacencies, they can leverage on potential synergies in tandem with their original business. In fact, it is because of these synergistic opportunities that we see many logistic SaaS startups in SEA having increasing overlaps with each other as they grow larger.

Waresix and Shipper were two of the earlier startups that began occupying the logistic SaaS space in Indonesia back in 2017, although from different starting points and value propositions. Contrary to the macro tailwinds of e-commerce and consumer internet across SEA since the 2010s, Waresix took a contrarian approach and focused with B2B warehousing services for businesses¹, before expanding further into freight delivery services shortly after.

On the other hand, Shipper capitalized on the structural e-commerce trend, and began first with last-mile deliveries for smaller MSMEs and individual e-commerce sellers². These MSMEs would usually keep 5-10 orders’ worth of inventory at home every day, and go to multiple drop-off locations because customers have different delivery options³. Organically, the needs for storage increased, and Shipper provided warehousing services as well.

Be it Waresix’s B2B logistics approach beginning with warehousing solutions expanding rapidly to freight and trucking deliveries, or Shipper’s B2C logistics approach beginning with courier deliveries expanding rapidly to warehousing solutions, it is evident that the abundance of adjacent supply chain inefficiencies allows all logistics SaaS startups to expand and generate synergies with their prior businesses, ultimately by providing a full-suite services within their platform.

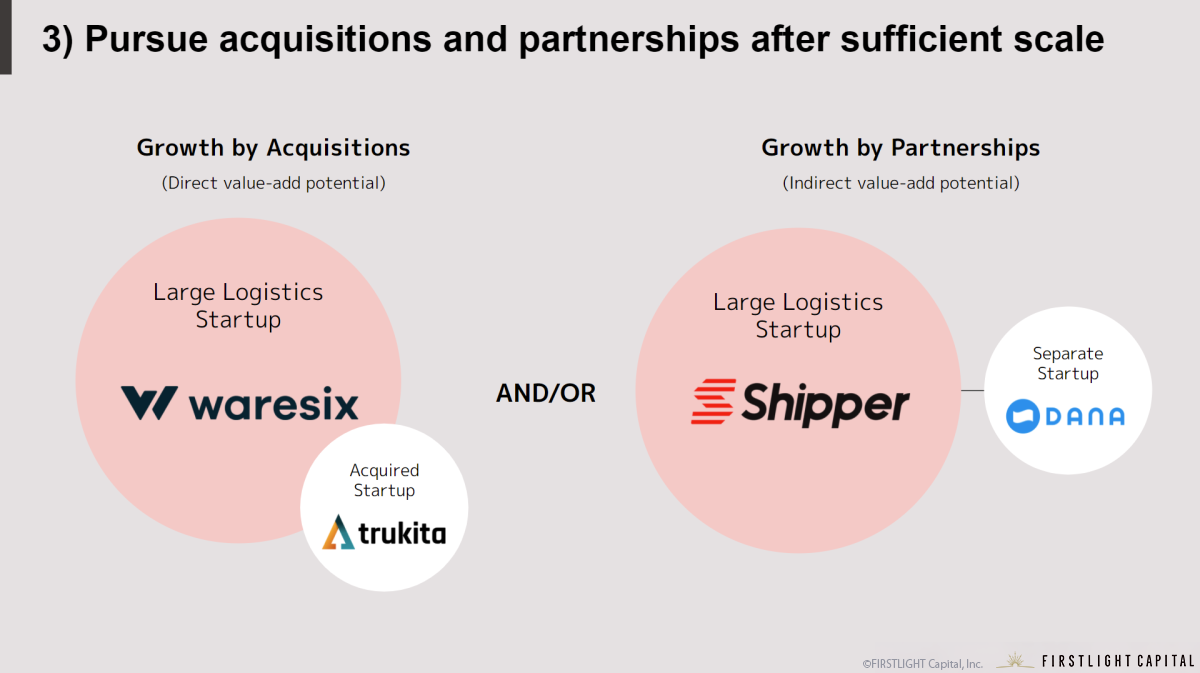

Pursue Acquisitions and Partnerships after Sufficient Scale

While creating new business across adjacencies is one primary mode of business expansion, startups that are able to reach a particular scale – usually Series B and beyond – will also begin to consider acquisitions and strong partnerships. Waresix and Shipper, once again, are the example startups who have been able to achieve scale and capital deployment capabilities to accomplish this.

An example of this growth strategy is Waresix‘s acquisition of Trukita. Trukita was another startup that operates by connecting businesses to shippers and warehouses, and already had 10k trucks in their fleet – so an acquisition would allow optimized cost structures and scale.

Moreover, as Waresix’s forte was at mid-mile delivery services (from warehouses to distributors), and Trukita’s was in first-mile delivery services (from ships to warehouses) to rapidly increase to enable first-mile services, lower customer costs, and effectively turning Waresix into one of the largest logistics technology providers in Indonesia.

Similarly, another example is Shipper’s partnership with Dana. However, instead of being a pure logistics startup, Dana is a fintech startup that provides consumers with digital wallets as an all-in-one payments app, similar to Paypay or Linepay.

Instead of executing an acquisition, which would be complicated since Dana’s services are not directly along the logistics supply chain, Shipper partnered with Dana via the Dana Delivery solution, allowing Shipper sellers to make orders through the Dana platform and pay using Dana’s mobile wallet service. This logistics-payments synergy nonetheless provides an optimal solution for both their end-users alike.

Conclusion

As we can see, logistics SaaS in Indonesia is ripe with opportunity, with a relatively defined playbook for growth. These common growth patterns that we can observe from the top-tier logistics SaaS in Indonesia are primarily due to the opportunities that present themselves along the entire supply chain. Since there is a huge fragmentation of the supply chain for various kinds of stakeholders, such as shippers, truckers, businesses and warehouse providers, we see many of the logistics startups tackle this via aggregation of information on their platform. With the consolidation and startups achieving scale, we are likely to see more convergence of various logistics startups providing similar full-suite offerings at scale, as well as eventually greater acquisitions and partnerships both directly and indirectly – providing abundant business as well as even exit opportunities in the coming future.

¹ KR Asia, “More than just arranging transports, Waresix wants to fix the Indonesian supply chain: Startup Stories”

² Techcrunch, “Shipper, a platform for e-commerce logistics in Indonesia, raises $5 million”

³ KR Asia, “Indonesian logistics company Shipper bags USD 63 million in Series B funding”

By Jorel Chan | FIRSTLIGHT Capital, Inc. Associate

2021.12.10

Here at FIRSTLIGHT Capital, we regularly deliver useful content on both Japanese and global startup trends, as well as hands-on experience from our very own venture capitalists and specialists. Please feel free to contact us via the CONTACT page if you would like to be in touch. Click here to follow FIRSTLIGHT Capital’s SNS account!