Across SEA, we have witnessed a rapid increase in VC deployments into startups in recent years, with many unicorns having emerged as well. From the first unicorn, Lazada, minted in 2013, the region has now seen 35 unicorns as of 2021, 19 of which became unicorns in 2021 to date. (*1)

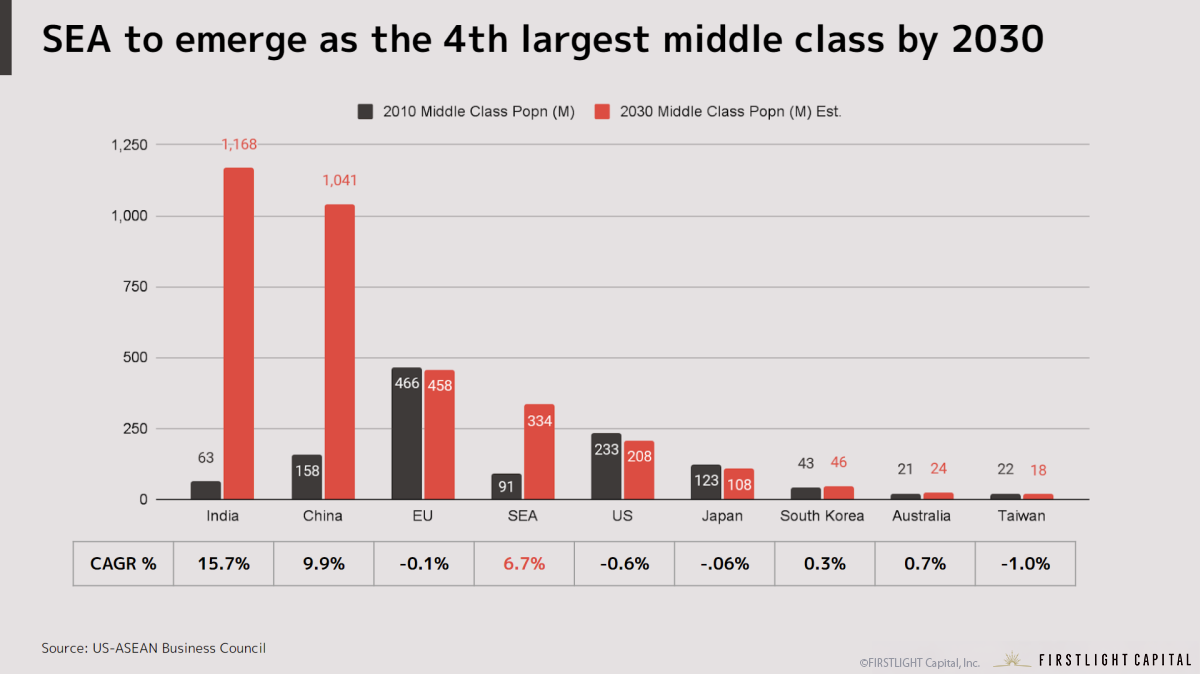

SEA as a region has been enjoying a rapid economic growth, mainly to a quickly and consistently expanding middle class, consequently leading to greater mobile and internet penetration, especially amongst teenagers and young adults. According to US-ASEAN Business Council(*2) estimates, SEA as an economic region is set to see a middle class growing at 6.7% CAGR to reach 334m people in 2030, to emerge as the 4th largest middle-class economy behind India, China and the EU.

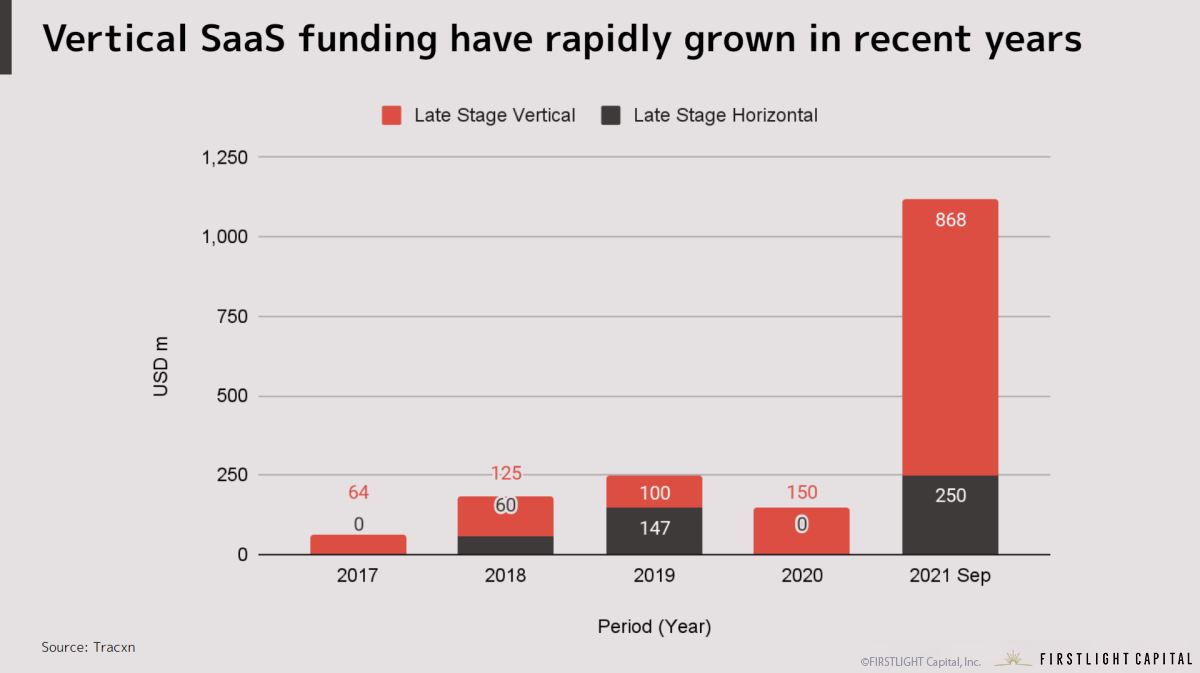

Needless to say, this growth has been the main driver of mobile-phone and internet penetration, with the overall expansion of the internet economy being further catalyzed by the pandemic, remote work, and deeper software dependence in everyday lives and commerce. Within this rapid development of the internet economy in SEA, many large rounds have been raised by very successful SaaS startups in the past 5 years. Late-stage vertical SaaS, specifically, have attracted the most capital, up to $868m in 2021, almost 3.5x that of late-stage horizontal SaaS in the same.

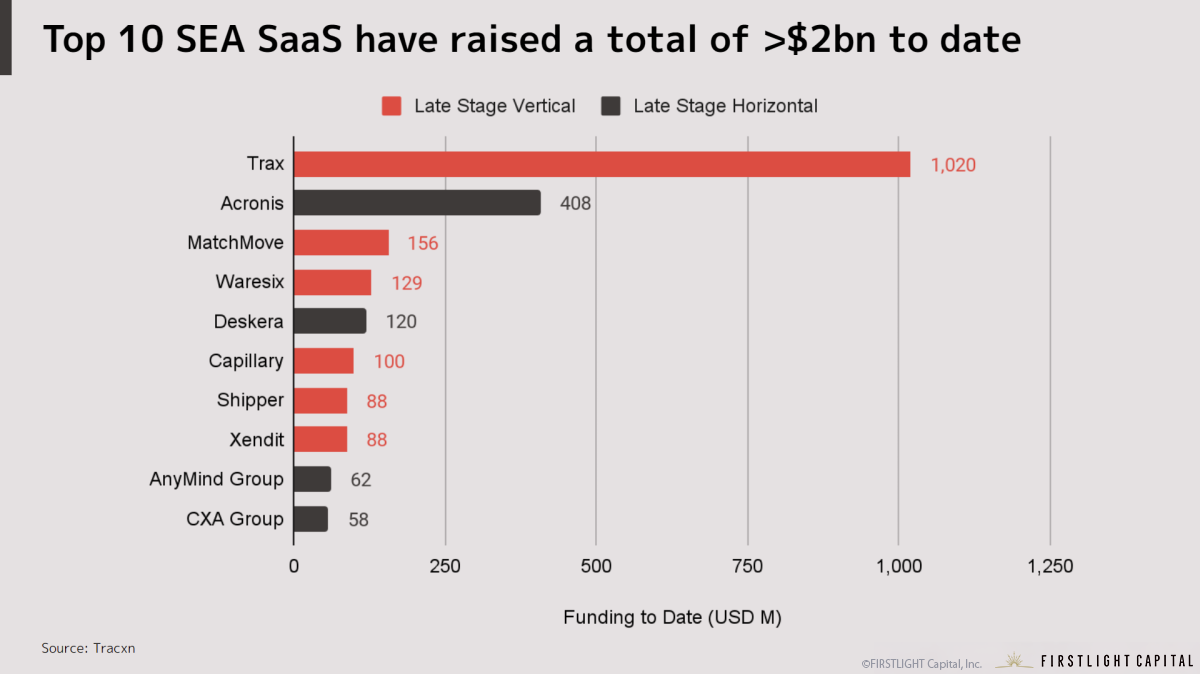

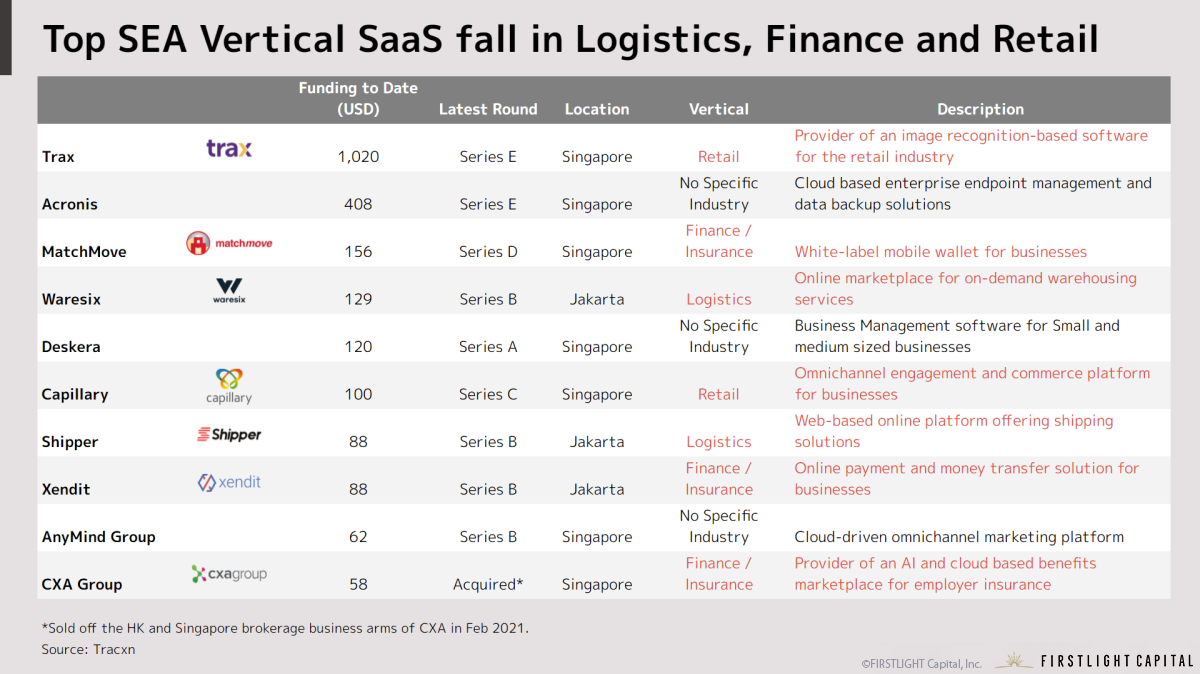

If we zoom in to the top 10 SaaS startups by fundraising, and analyze more broadly their fundraisings since their founding, it is evident that they have raised over $2bn to date in total. Trax, an retail SaaS startup that deploys image-recognition and data analytics to streamline inventory management, leads the pack at $1bn in funding, with Acronis, a cloud-based data storage startup at $408m so far.

What are some common characteristics of these successful vertical SaaS, and how can we understand their respective growth strategies? By categorizing the top 10 SaaS startups and categorising them by their respective verticals, it is evident that the vertical SaaS occupy similar industries of retail, finance/insurance and logistics/shipping.

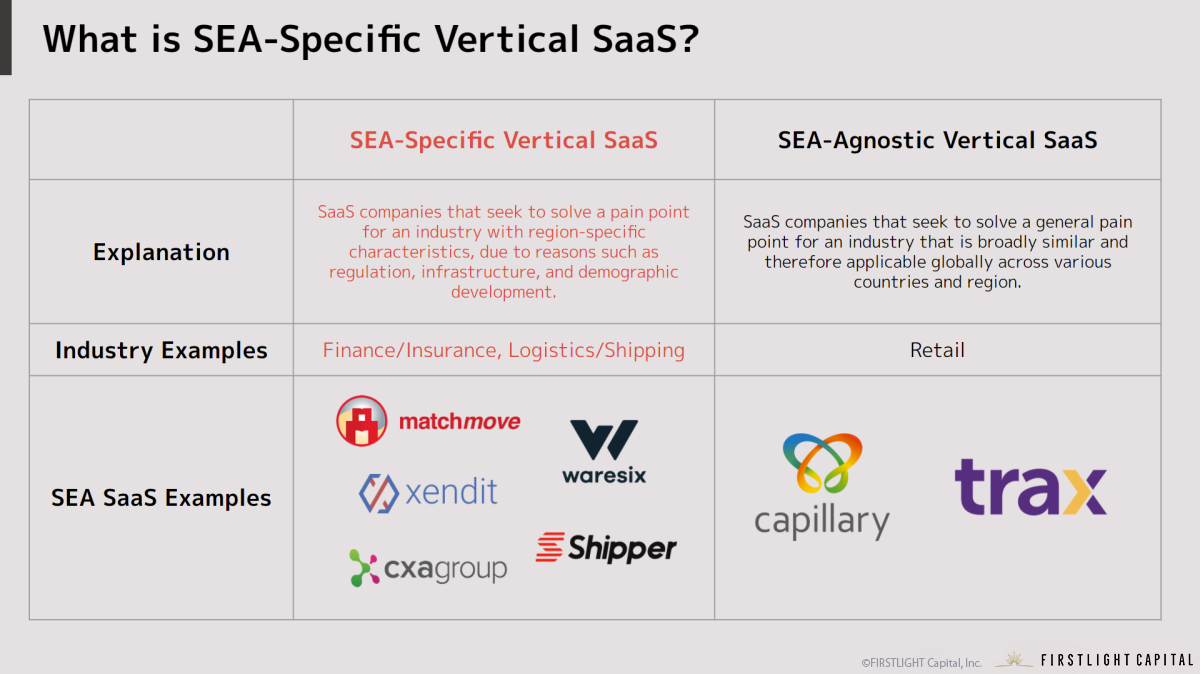

Generally speaking, the vertical SaaS startups in SEA can be broadly categorized into two main types, which follow two different types of growth patterns: a) SEA-specific Vertical SaaS, and b) SEA-agnostic Vertical SaaS. SEA-specific Vertical SaaS refer to vertical SaaS companies that focus on solving an industry pain point that is specific to the country or market it is based in. SEA-agnostic Vertical SaaS, on the other hand, refer to companies that are tackling industry pains that are more general and therefore bear similarities across different countries – in this sense, the general understanding is that their growth strategies are more similar than they are different from wildly successful startups from US and Europe.

For this article, as we would like to explore what exactly makes SEA so unique and different from other regional markets in the world, we will be focusing on a) SEA-specific Vertical SaaS. SEA-specific Vertical SaaS often target industry verticals with a strict regulatory environment, a local value chain infrastructure, or deep domain-specific expertise required. Finance/Insurance and Logistics/Shipping fall within this category for these reasons.

SEA-Specific Vertical SaaS: Logistics

The logistics space in SEA has always been a key industry with abundant supply-side opportunities for disruption. This is due to two fundamental points relating to SEA’s geography.

Firstly, logistics is key due to international trade – SEA is situated at the heart of the Maritime Silk Route, with the Straits of Malacca carrying >40% of all global maritime trade between Europe and Asia. This makes shipping and logistics the economic lifeblood for many SEA countries, especially Singapore, Malaysia, and Indonesia. In such a manner, it is in both national and private interests to protect and ensure that this industry thrives. In this sense, having the government closely involved in the maturity of the shipping industry’s regulatory environment, providing the tailwind for startups to possibly find potential areas of innovation.

Secondly, logistics is key due to intra-national trade – most middle-income SEA countries are archipelagic states who need to manage complex supply chain shipping across its many islands. Countries like Indonesia (6000 inhabited islands) and the Philippines (2000 inhabited islands) continue to face technological challenges with regard to managing and streamlining the complex supply chain infrastructure for logistics nationwide.

In this regard, Indonesia-based logistics SaaS startups such as Waresix and Shipper have been leading this massive boom in business expansion and venture capital growth. Armed with over $129m of funding to date, Waresix is a 2B logistics marketplace that connects shippers and businesses with available warehouses and trucks across Indonesia, already serving across 229 cities, with 53 trucks and 431 warehouses under management. Shipper, has a wider focus for both consumers and vendors, provides a multi-courier shipping platform to distributed warehousing & fulfillment networks.

Essentially, what Waresix and Shipper are doing is – seamlessly integrating data analytics for businesses and deploying a web-based one-stop shipping platform – leverages on automation to solve the supply chain inefficiencies in Indonesia’s complex and legacy logistics infrastructure.

SEA-Specific Vertical SaaS: Finance

Finance is another SEA-specific space that is growing rapidly with the rise of SaaS – specifically in the payments and banking space. The fundamental reasons are mainly demographic and technological. Behind China, India and the EU, the SEA region as a whole is projected to become the world’s next largest middle class by 2030 at today’s growth rates. The emergence of a middle class is generally correlated with higher consumer spending worldwide – the difference this time is how the internet has rapidly driven the mass adoption of new modes of cashless payments amongst the SEA middle class. In this manner, it makes sense how payments SaaS have emerged as the overarching infrastructure in the internet.

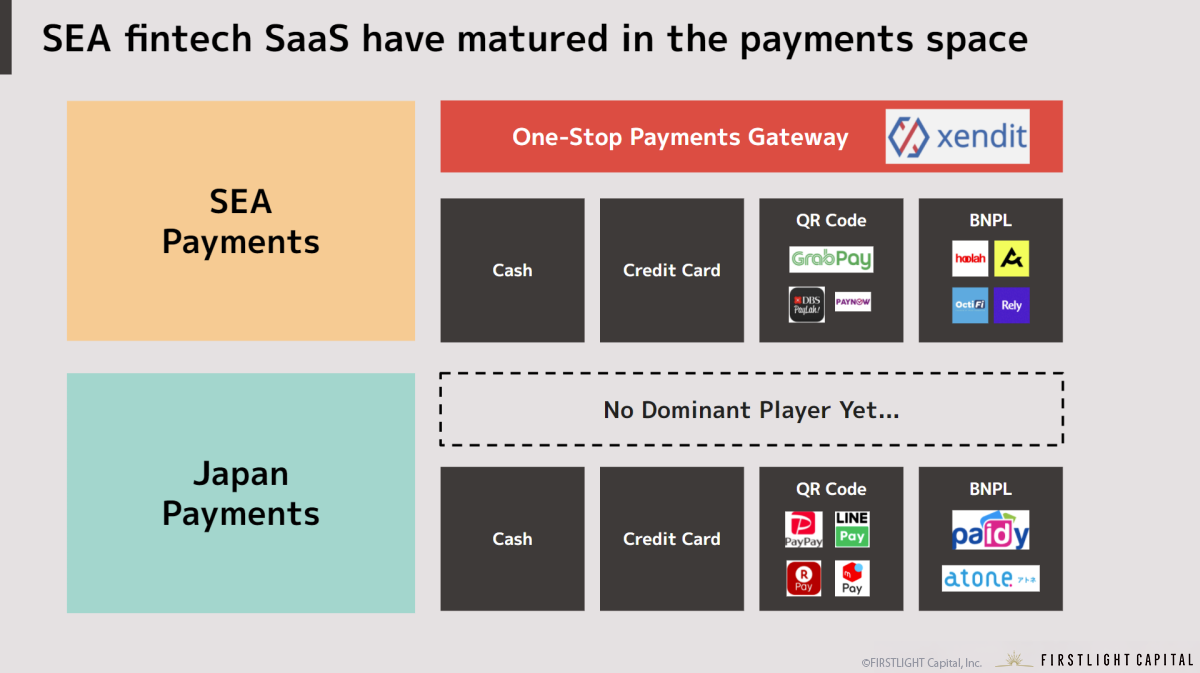

The first emergence of tech startups in SEA a decade ago occupied the Consumer Digital category, with mobile e-commerce platforms and super apps such as Grab, Lazada, Shopee, Gojek, Tokopedia, and Traveloka, that enabled daily-life transactions for the middle class, such as ordering food, paying bills, getting a ride, etc. – all cashless via QR codes like GrabPay, DBS Paylah! and Paynow, BNPL like Hoolah or Rely. Similarly, in this sense, Japan has also recently arrived at a greater adoption of cashless methods, albeit more gradually, through apps like PayPay, LINEPay or Paidy.

However, what sets SEA’s payments infrastructure ahead of Japan is how technology is already being built for a one-stop 2B payments gateway infrastructure. With this array of consumer digital platforms matured, startups have moved to automate the infrastructure for businesses to facilitate the greater ease of such consumer transactions.

Essentially, this one-stop infrastructure is what Xendit and Matchmove are building. Xendit is a Indonesia-based merchant-focused payments platform that allows for sending and receiving payments seamlessly, no matter what type of payment gateway is used, not only cash but also QR codes and 20+ different methods. And on a broader level, Matchmove is a Singapore-based enterprise-focused banking platform that acts as an all-in-one payment solution for customers, not only by creating virtual accounts for spending, but also facilitating remittance, loans, expense management services, amongst others. As the digitally-savvy middle class emerges and spends more, SMEs and enterprises alike are incentivized to keep up and implement digital automations to streamline every aspect of the transaction and settlement process.

Conclusion

SEA has seen explosive growth both the maturity of startups and amount of VC funding. As we enter the next decade of the 2020s, we have already witnessed an emergence of SEA-specific vertical SaaS, especially in logistics and finance. Recognizing SEA’s importance in global maritime trade and its complex archipelagic geography, logistics startups such as Waresix and Shipper have proven to be successful in streamlining the supply chain through one-stop warehousing and fulfilment. Similarly, the rise of SEA middle class coincides with the age of a matured global technology infrastructure, we see a huge rise in payment startups like Xendit moving to create a one-stop payment gateway – it is precisely because of the rise of this new class of digital-native SEA consumers, that we are now bearing witness to a new wave of SEA-specific vertical SaaS startups tackling these newer challenges every day.

*1 Nikkei Asia, “Southeast Asia hosting more unicorns as internet economy takes off”, 15 Oct 2021

*2 US ASEAN Business Council, “Growth Projections”, 22 July 2019

By Jorel Chan | FIRSTLIGHT Capital, Inc. Associate

2021.11.02

Here at FIRSTLIGHT Capital, we regularly deliver useful content on both Japanese and global startup trends, as well as hands-on experience from our very own venture capitalists and specialists. Please feel free to contact us via the CONTACT page if you would like to be in touch. Click here to follow FIRSTLIGHT Capital’s SNS account!