Never Repeat a “Digital Defeat”: A Strategic Manifesto for Physical AI

2025.07.04

— Why Japan Must Identify Its Winning Path in the Intensifying Global Physical AI Arena

The Ministry of Economy, Trade and Industry’s Digital Economy Report delivered a shock estimate that Japan’s “hidden digital deficit” could swell to ¥45 trillion by 2035.

Not only in the IT and software fields dominated by GAFAM, but even in hardware and manufacturing sectors—such as the automotive industry where Japan has long excelled—the share of software in product value is rising rapidly, threatening the nation’s industrial foundation.

Although domestic coverage remains limited, the Physical AI field—symbolized by humanoid robots—is seeing fierce international competition led by start‑ups in the United States and China. A new battle for hegemony has begun, and its outcome will decide the future of Japanese industry.

If Japan neglects investment in this field, a harsh scenario of industrial decline may become a reality. As robotics spreads globally, another “Made in Japan” domain could be lost.

Yet the Physical AI arena is only at the first or second stage of genuine development. Japan still holds technological bases and intellectual property that, if leveraged, leave ample room to create unicorns.

We must learn from past “defeats.”

Although i‑mode was a groundbreaking invention that realized the world’s first mobile internet, in the smartphone era Japan ceded the platform to iPhone and Android.

Japan excels at inventing foundational technology but fails to elevate it to global products—this is the challenge. We must not repeat this history in Physical AI.

This article outlines Physical AI and explores how Japanese start‑ups can chart a winning course in the field.

The Rapidly Intensifying Physical AI Arena—Beyond Our Awareness

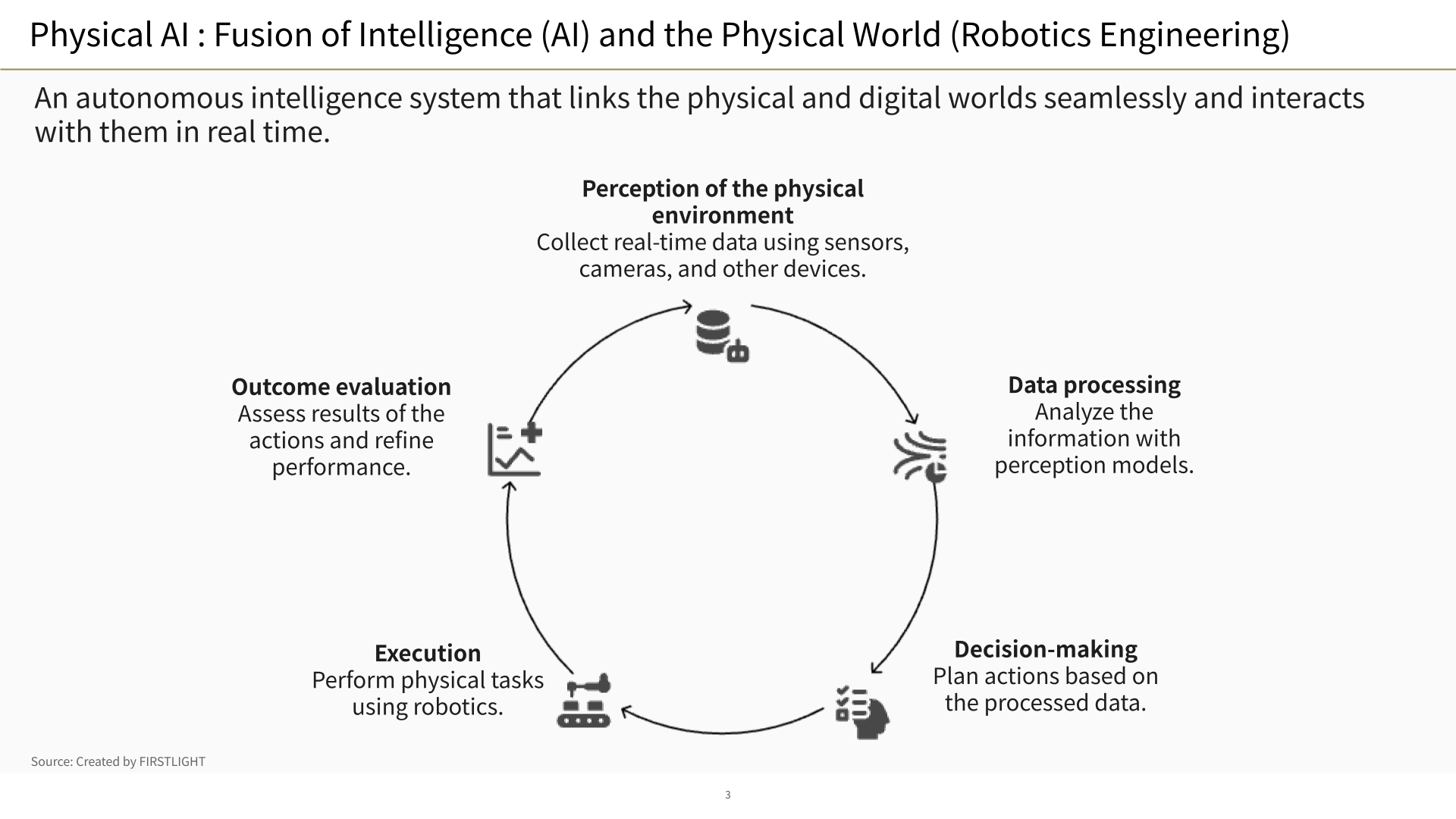

Physical AI refers to “systems that fuse artificial intelligence (AI) with robotics technology, autonomously executing tasks and actions in the physical world.” By combining AI with robotics, IoT, and sensing technologies, it applies to controlling, judging, and physically performing tasks in real space.

Concrete examples include:

Manufacturing: humanoid robots place and weld metal parts.

Agriculture: AI and sensors analyze soil conditions, while robots handle seeding and harvesting.

These tasks originally required both the physical abilities and intelligence of humans, and Physical AI seeks to replace them with technology.

The essence of Physical AI is the fusion of hardware and software, which is precisely why I focus on this field.

The arena is drawing global attention—especially from the US and China—and investment is accelerating. Behind this are structural demand‑and‑supply factors: advances in AI and related technologies, and rising labor costs, particularly in advanced economies.

The US–China “Next Hegemony Battle”

In the United States, former Google Brain researchers are founding start‑ups and raising hundreds of millions of US dollars each. The $470 million raised by Physical Intelligence is emblematic.

China, on the other hand, has declared “AI + Manufacturing Power” as a national strategy and is pouring vast funds and talent under government leadership. In Shenzhen, robotics pilots are everywhere, and the intensity is incomparable to Japan.

In large language models (LLMs) the US leads while China pursues fiercely; the same pattern is emerging in Physical AI. If Japan stands idle, it will again be relegated to spectator status.

〇 Technological Advances Enabling Physical AI

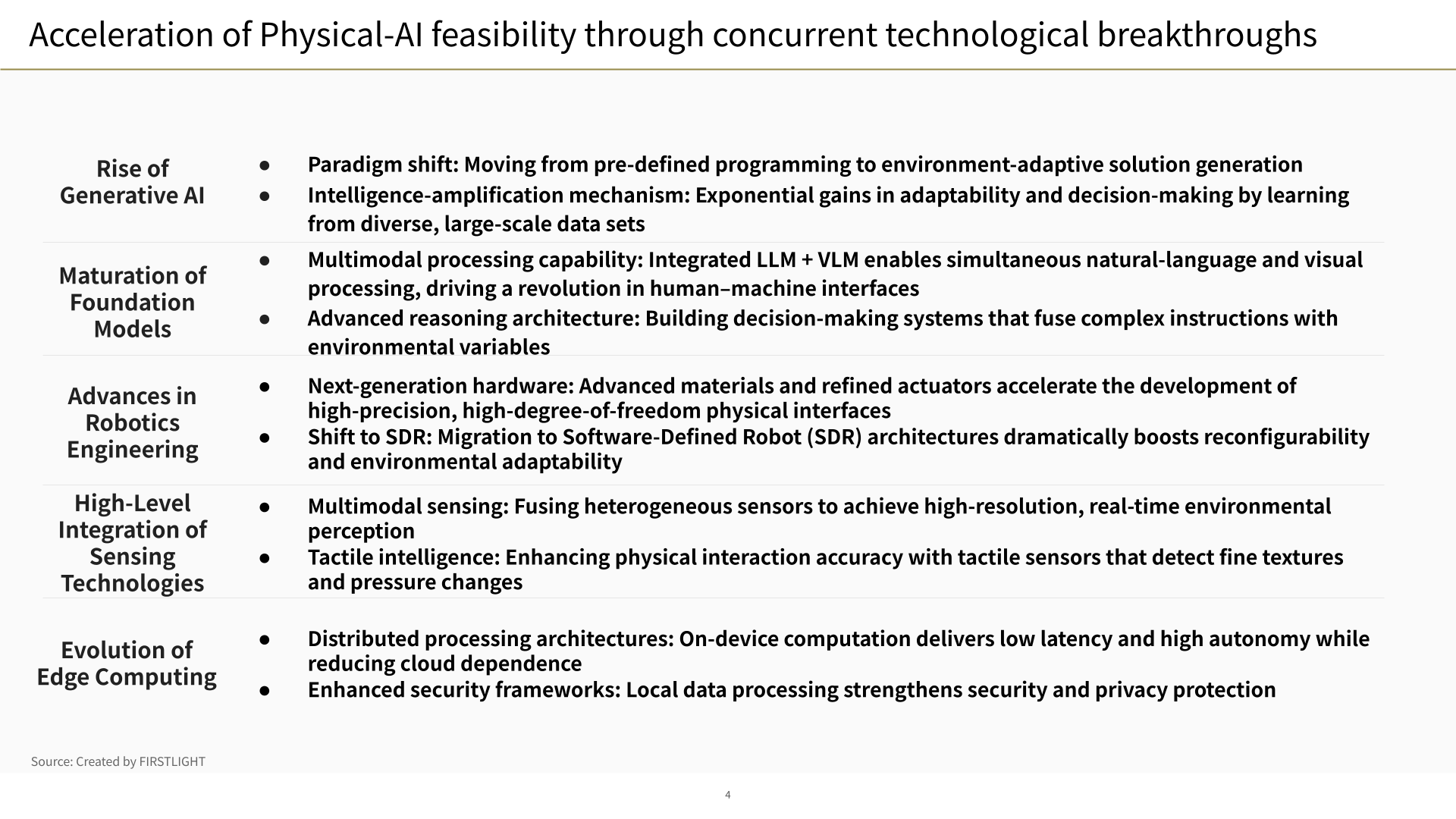

Traditionally, AI and robotics were treated as separate technological fields. Recently, however, multiple technologies that drive their fusion have advanced simultaneously.

Multimodal AI: Vision‑Language Models (VLMs) that integrate vision and language have appeared, enabling advanced processing of object recognition and spatial understanding.

Edge Computing Evolution: Data processing that once relied on the cloud can now be executed in real time and autonomously on the device itself thanks to advances in distributed architectures. This shift makes on‑site Physical AI—capable of instant decision‑making and control—a realistic prospect.

Hardware Advancements: Concurrent progress in compact, high‑performance AI chips, improved sensor accuracy, and refined actuators has brought the field to practical levels.

〇 Growing Need for Social Implementation

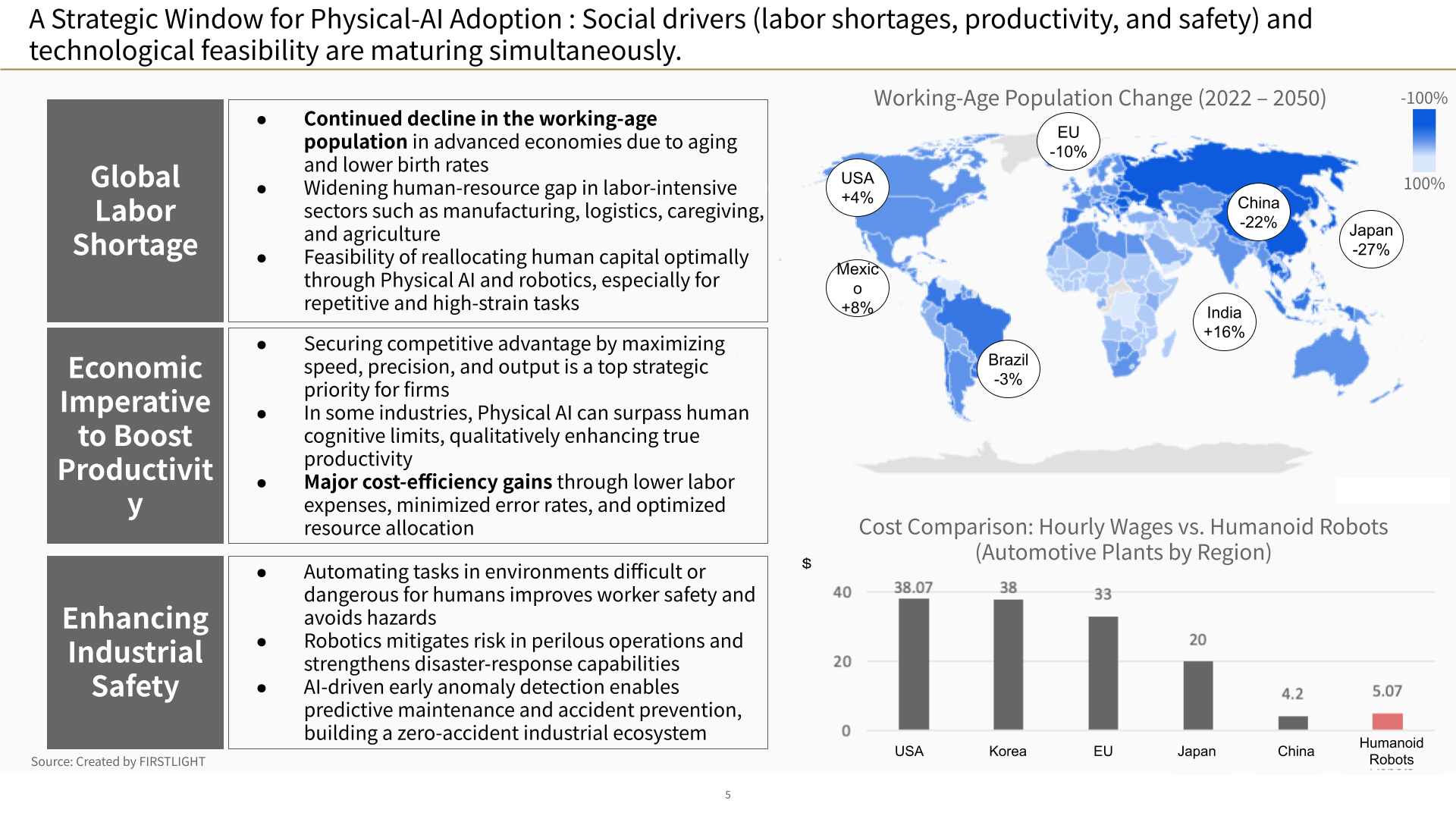

In addition, rising labor costs have increased the demand for adoption.

Except for the United States and Mexico, labor forces in advanced nations are projected to decline.

In many advanced economies, labor costs climb year by year, prompting companies to consider robots as a means to avoid persistently high expenses.

Indeed, customers of our portfolio companies frequently remark, “We can’t hire people” and “Labor costs keep rising.” This is not a temporary phenomenon but a structural shift.

Robot Advantages:

No risk of resignation, 24‑hour operation, ability to handle dangerous tasks—thus reducing labor risk.

Price Declines:

Technological progress and mass production effects lower per‑unit costs, improving profitability.

Humanoid Robots—The Flagship of Physical AI

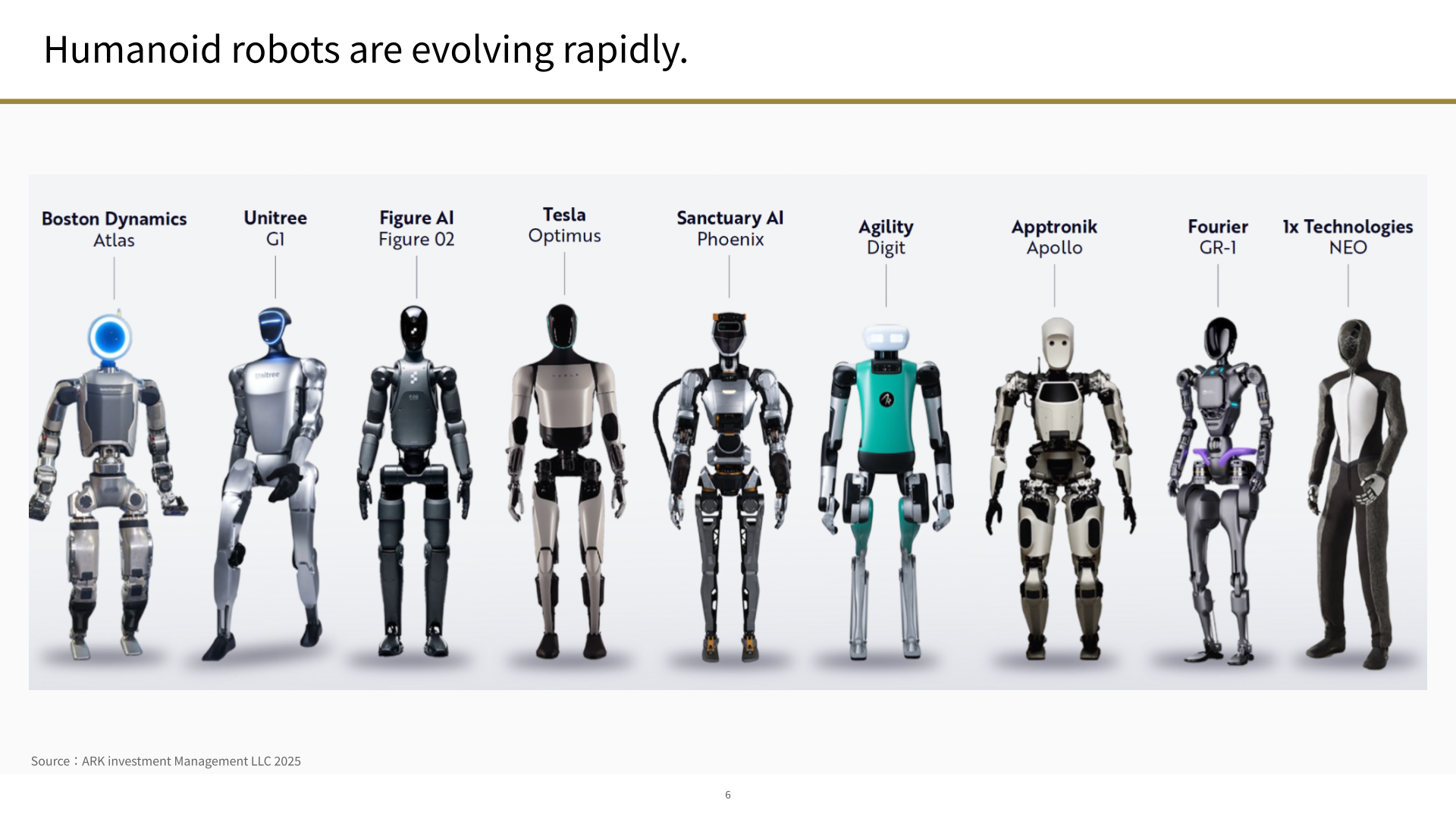

Humanoid robots attract the most attention as flexible, general‑purpose solutions to structural labor shortages.

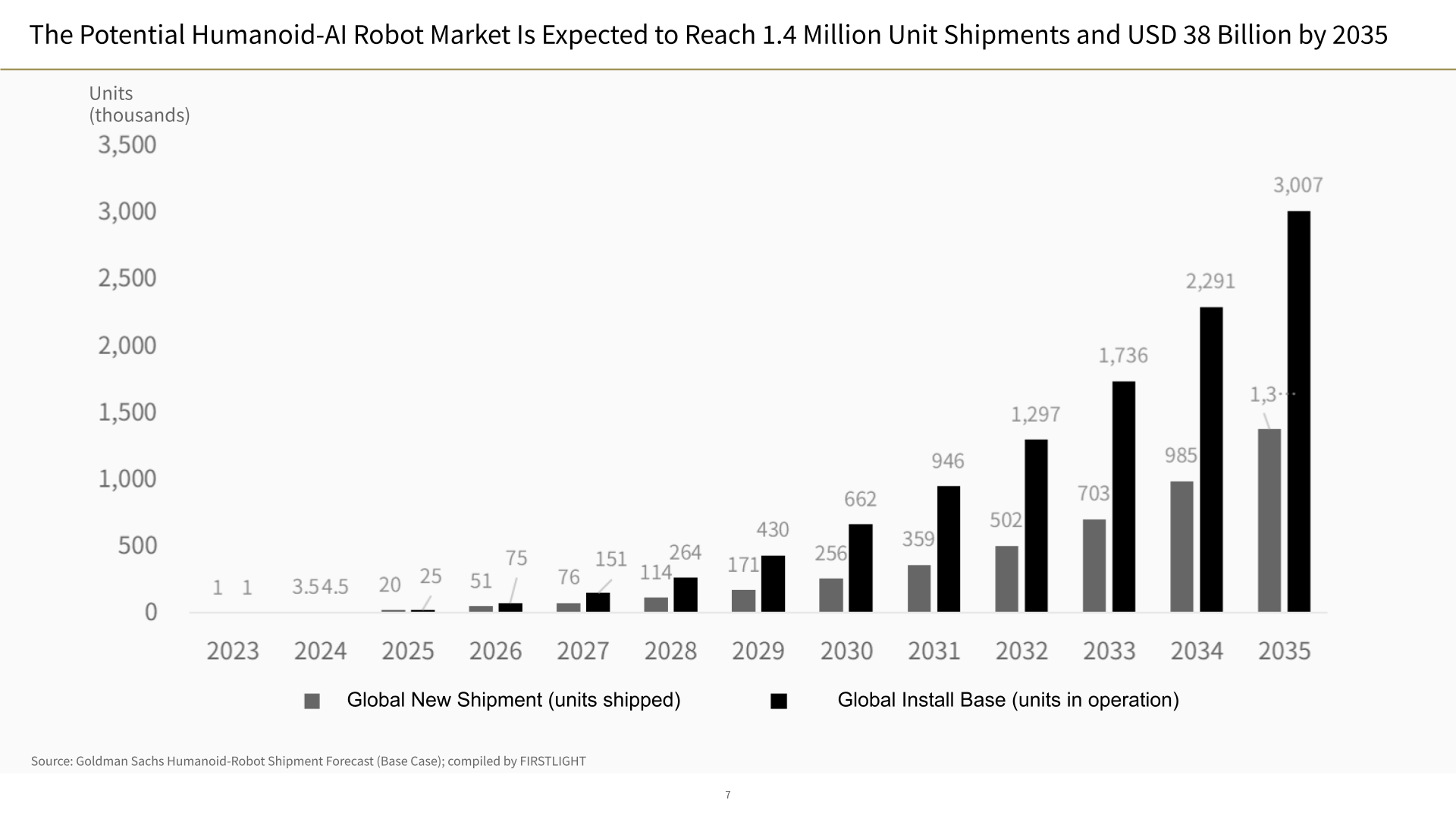

A 2024 Goldman Sachs report forecasts 1.4 million units shipped annually by 2035, with a market size of $38 billion, indicating a shift into full social implementation.

Where traditional industrial robots automated single, fixed tasks, AI‑equipped humanoids are expected to function as infrastructure bearing economic activity in labor‑scarce sites.

The Rationality of the “Human Form”

Best suited to existing workspaces and collaboration with humans.

Can blend naturally in service, caregiving, cleaning, reception, and many other scenarios.

Chinese‑made serving robots are already appearing in Japanese restaurants, and in the future offices, factories, and stores may be dominated by foreign robots.

Post‑COVID Revival of Start‑up Investment

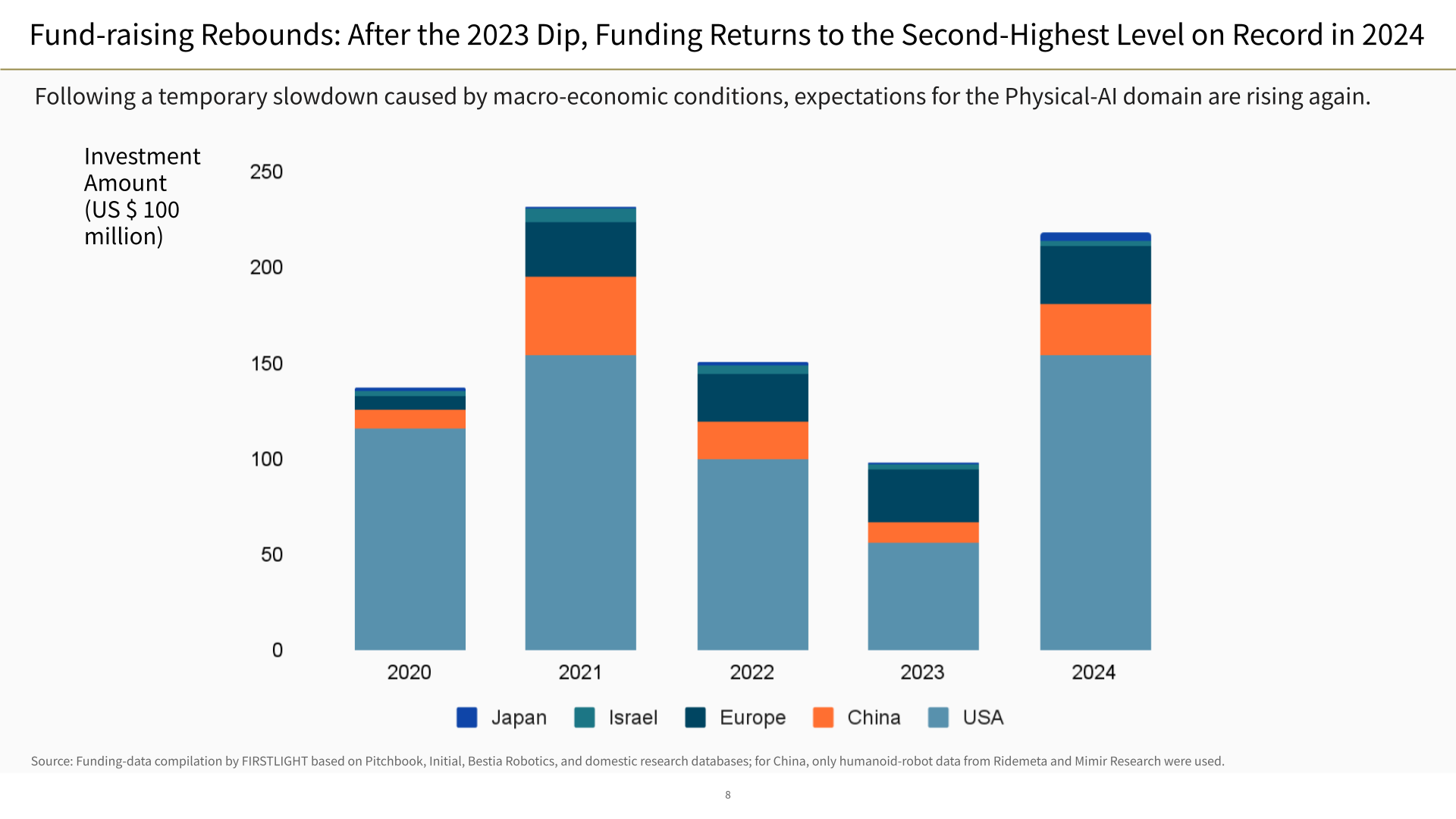

Next, we examine the global funding landscape for start‑ups related to Physical AI.

The slide below shows investment amounts by country and region in the Physical AI domain, which primarily covers robotics and AI. (Note that the figures for China represent investments focused specifically on robotics, whereas the numbers for other countries also include broader robotics‑related areas such as autonomous driving.)

Funding for Physical AI‑related start‑ups recovered in 2024 to the second‑highest level on record. As competition in generative AI reaches a lull, investors shift focus to Physical AI as the “next growth story.”

In fact, we now frequently hear overseas venture capitalists saying, “Physical AI is next.”

In Japan, the AI Robot Association was established in late 2023, and METI launched a related data‑collection program; yet funding remains small and the gap with global peers is large. Greater capital injection and start‑up nurturing are urgent.

China’s National Focus on Physical AI

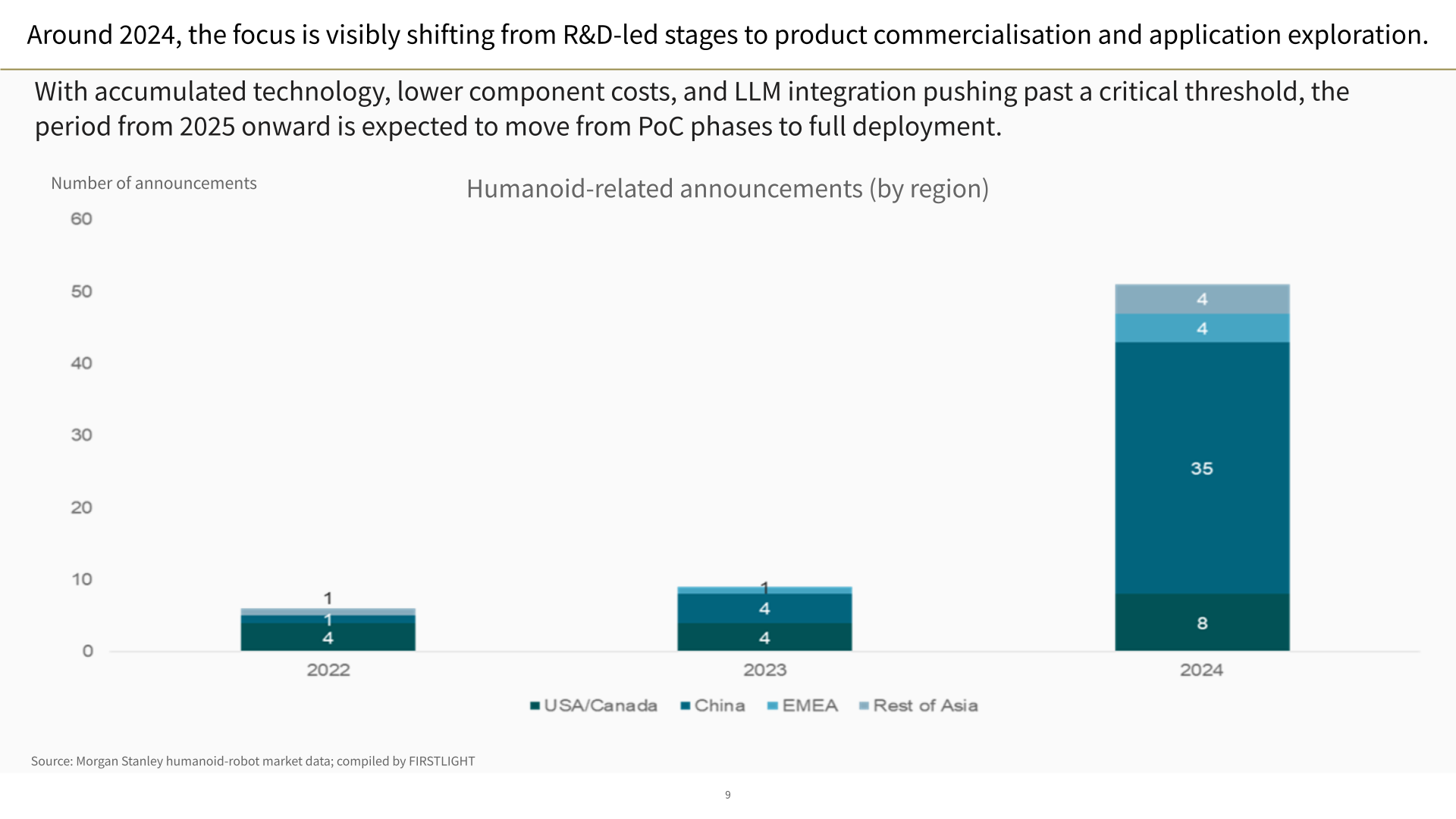

Surveying trends over the past two to three years, we can confirm that around 2024 the development phase of Physical AI has undergone a major shift. Until then, activity had remained at the stage of technology exploration and early verification—R&D, algorithm testing, and limited proof‑of‑concept pilots. From late 2023 through 2024, however, Germany, the United States, China, and others have been making a full‑scale move into the commercialization phase, with clear changes in project size and objectives.

China, in particular, is waging a national all‑out effort, accelerating:

- Supply‑chain establishment for Physical AI components

- Practical multimodal processing by integrating VLMs and other foundation models

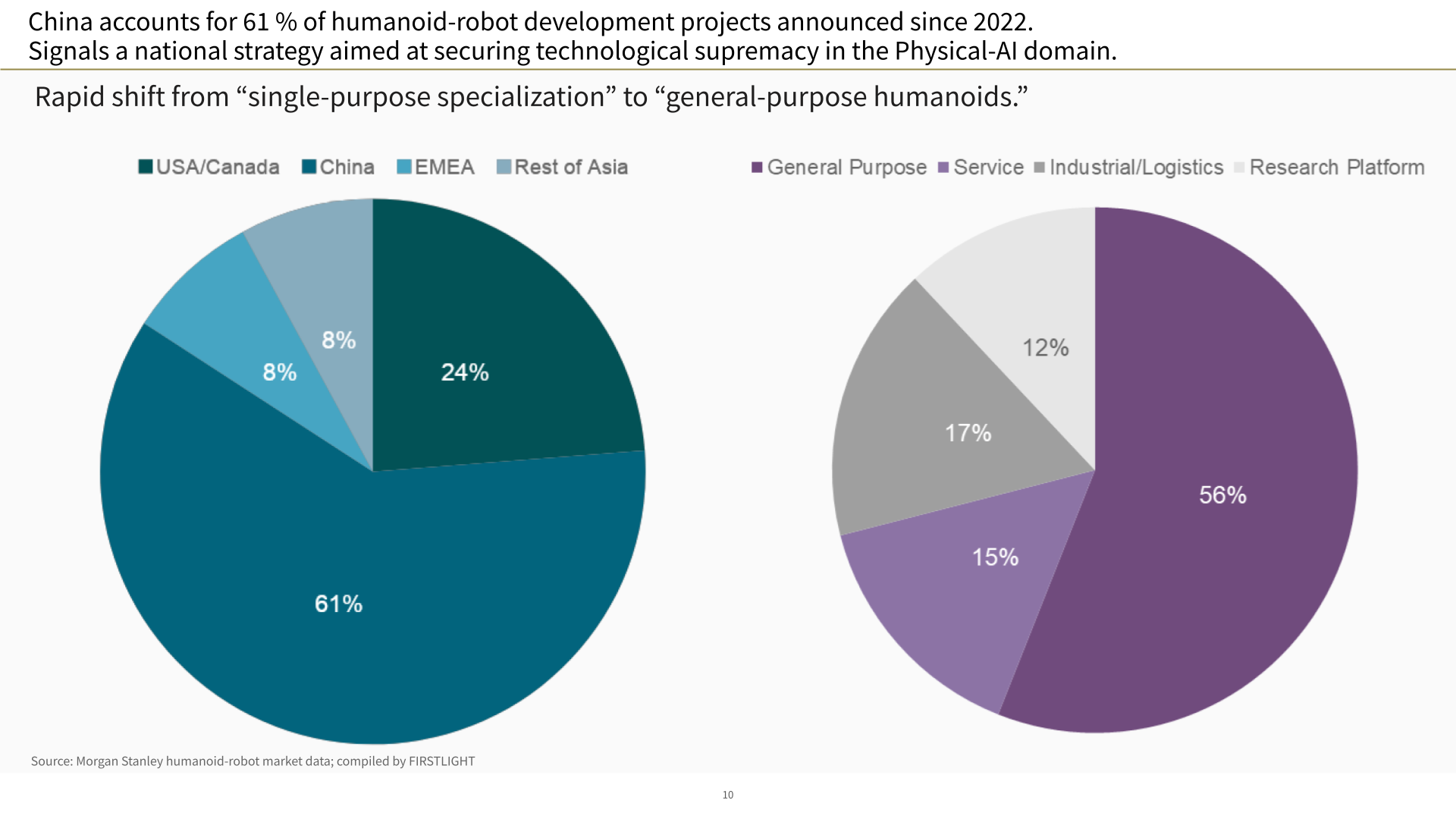

In 2024 alone, China announced 35 humanoid‑related projects, accounting for about 60 % of the world’s developments.

Taken together, these trends show that Physical AI is no longer a fleeting buzzword; it is asserting a clear presence as a domain into which countries and corporations are now moving in earnest. The widening scope of corporate initiatives and the swelling size of investments are powerful signals that validate this shift.

Another noteworthy development is the transition in humanoid‑robot applications from single‑purpose machines to general‑purpose humanoids capable of making their own decisions. As of 2024, roughly 60 % of humanoid‑robot projects worldwide are being developed in China.

Behind this lies the Chinese government’s “AI + Manufacturing Power” strategy. In China, Physical AI—particularly the humanoid segment—is positioned not merely as a start‑up opportunity but as a national priority backed by strong policy and financial support.

Consequently, government‑led funding injections and regulatory measures have accelerated, dramatically increasing the speed at which public‑ and private‑sector collaboration is moving into the commercialization phase. This is reshaping competitive dynamics in the global market.

Notable Start‑ups

Up to this point, we have discussed global trends and the broader start‑up landscape; now let us highlight the specific start‑ups to watch in this field.

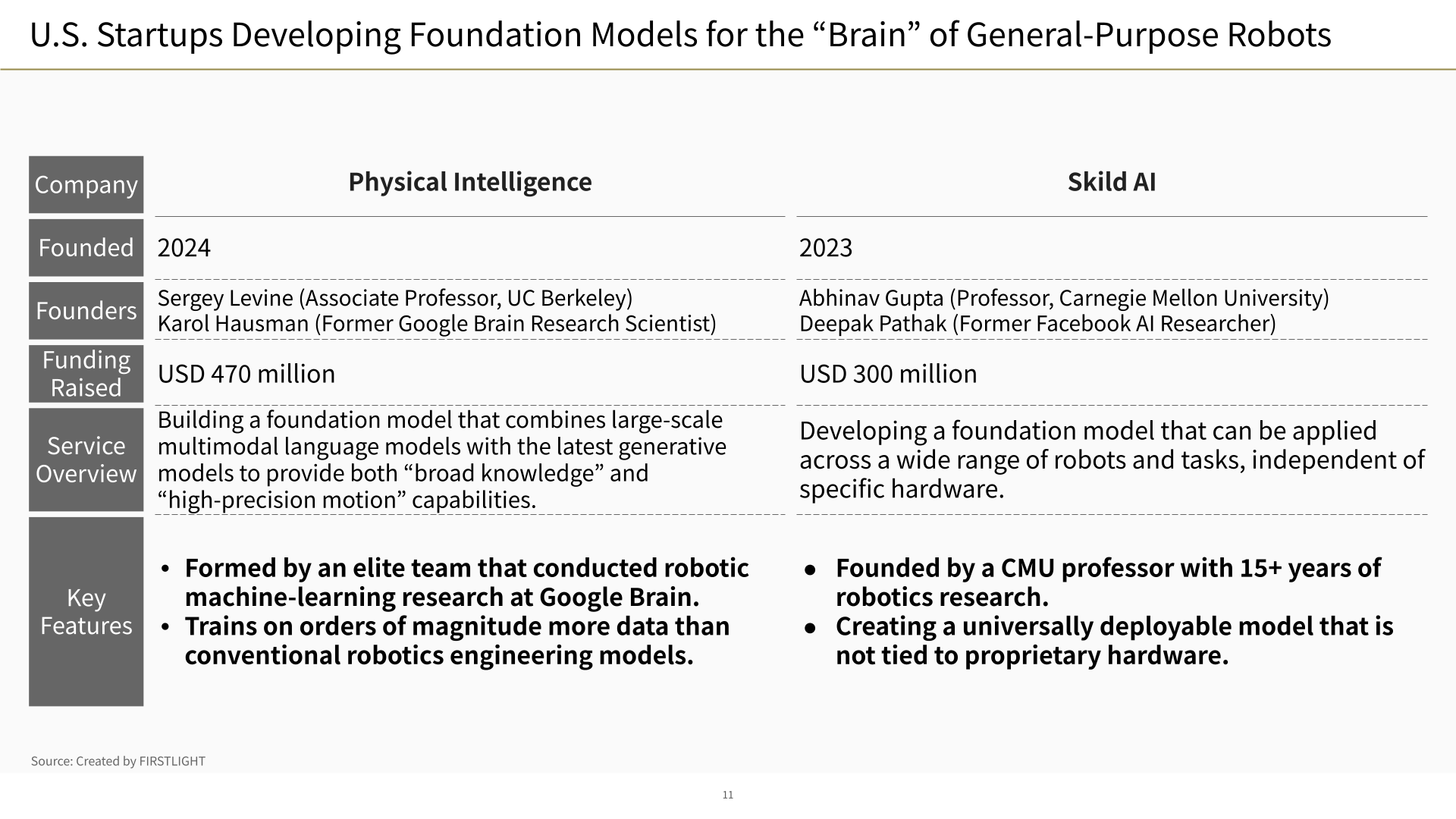

In the United States, two companies stand out: Physical Intelligence and skild.AI.

Both are developing the brains of robots—essentially a “ChatGPT for robotics.”

Physical Intelligence was founded by a team of former Google Brain researchers and is building a general‑purpose motion‑intelligence platform anchored in large language models (LLMs).

Established in 2024, the company raised US $470 million that same year.

These start‑ups are key players focused on standardizing the software layer—the “brain” of robotics.

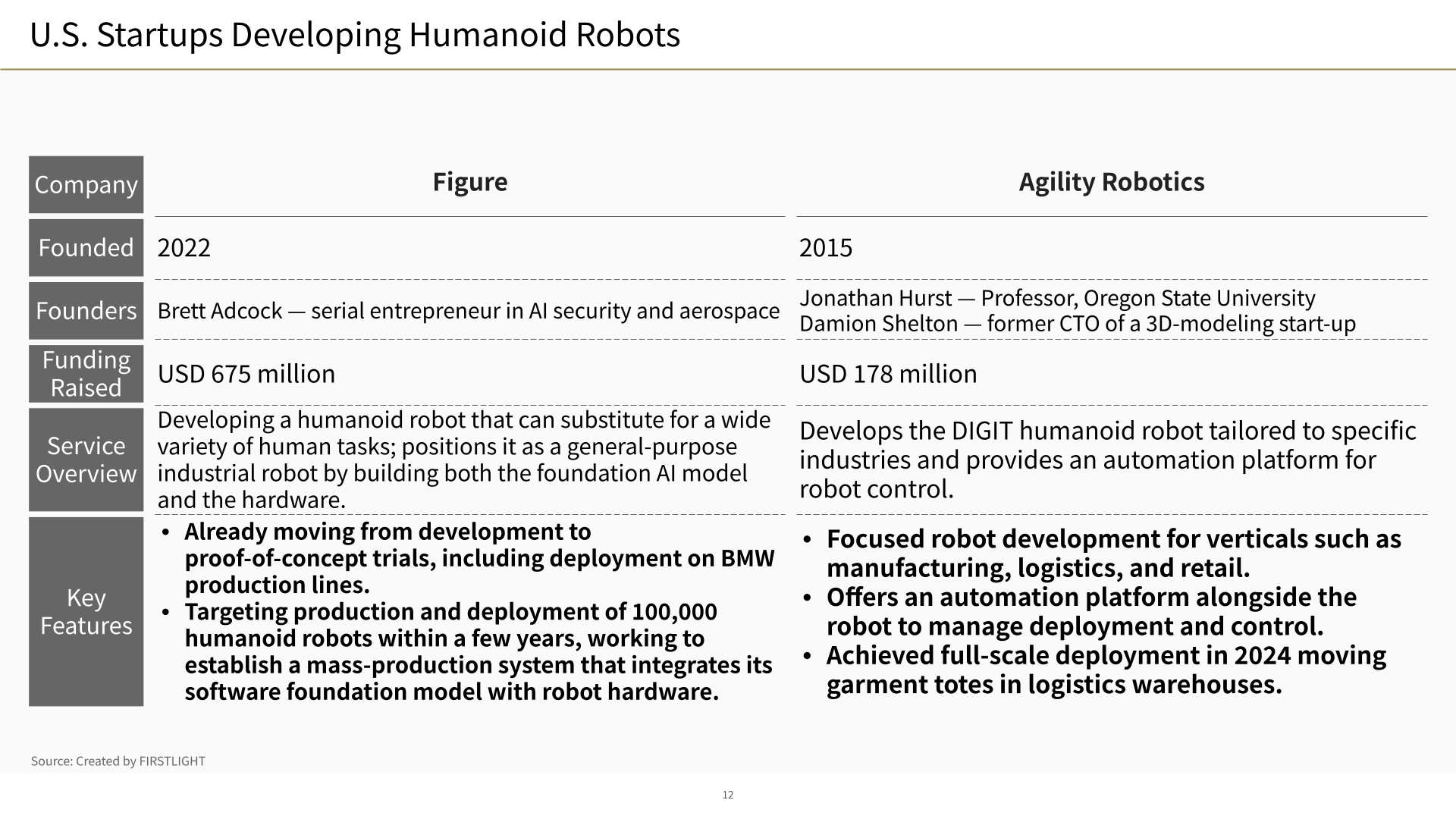

Next are two companies developing humanoid robots.

Figure AI manufactures its own robot bodies, develops its foundation AI model, and operates a vertically integrated business model that carries through to mass‑production deployment. A proof‑of‑concept is already underway on BMW’s production line.

Agility Robotics is developing bipedal robots specialized for industries such as retail and logistics; implementation has begun, including initial use in Amazon warehouses.

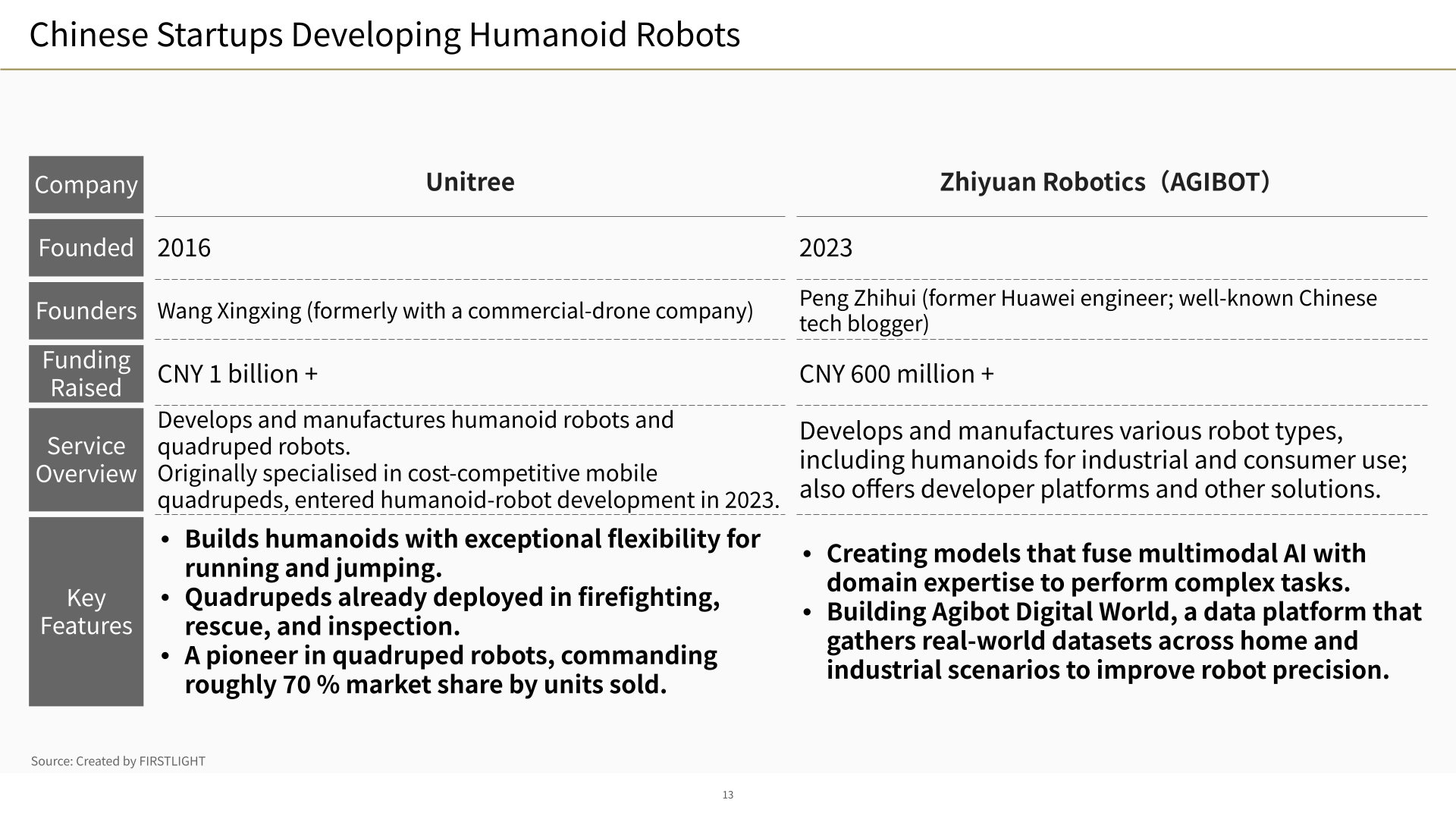

We then move to Chinese start‑ups. Chinese firms are notable for advancing technology development and mass‑production cost reduction simultaneously.

The two fastest‑rising players are Unitree and AGIBOT, the latter founded in 2023 by Peng Zhihui, hailed in China as a “prodigy.”

Unitree first gained fame for quadruped robots and in recent years has entered the low‑cost humanoid market. Deployments are advancing in firefighting, security, and inspection within China, and its greatest weapon is price competitiveness.

The company owns a domestic supply chain capable of producing every robot component in‑country, enabling it to leverage economies of scale and keep unit prices low.

AGIBOT, by contrast, follows an approach that blends elements of America’s Physical Intelligence and Figure AI. It is gathering massive on‑site data at its own facilities to build a training foundation for models that excel in real‑world environments.

It is worth noting that in China, funding injections and mass‑production frameworks are being established not only by the private sector but also under national strategy.

Why Japan Has a Winning Path in Physical AI

So far, we have surveyed the evolution of Physical AI and investment trends overseas; from here, I wish to focus on why Japan must tackle this field strategically. As an investor who travels frequently between Japan, the United States, and China, I sense firsthand that Japan possesses a unique potential unlike that of any other country.

The United States and China leverage abundant capital and speed to lead in general‑purpose AI and robotics. Japan, however, still has room to carve out its own winning path through a different approach.

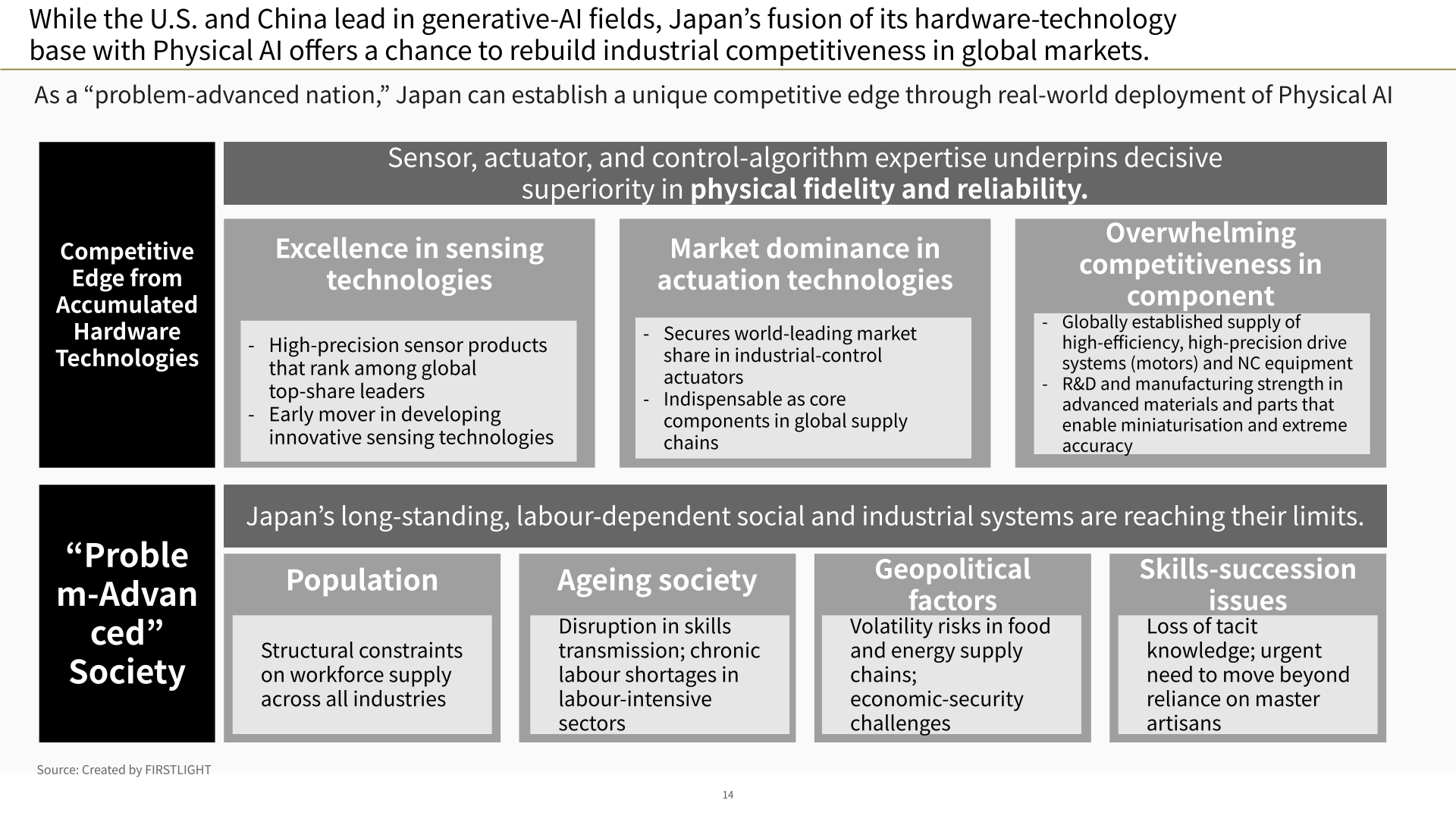

Japan stands at the crossroads of serious social challenges (labor shortages, ageing population) and advanced on‑site technological assets (sensors, actuators, precision processing).

Digitizing the Toyota Production System, ‘kaizen’ (a practice of continuously improving business processes, products, and services), and artisanal skills could produce the world’s strongest domain‑specific AI.

And the country also possesses world‑leading sensor, actuator, and precision component manufacturing technologies.

Hardware‑software fusion is Japan’s forte, differentiating it from the US (software‑centric) and China (mass‑production‑centric).

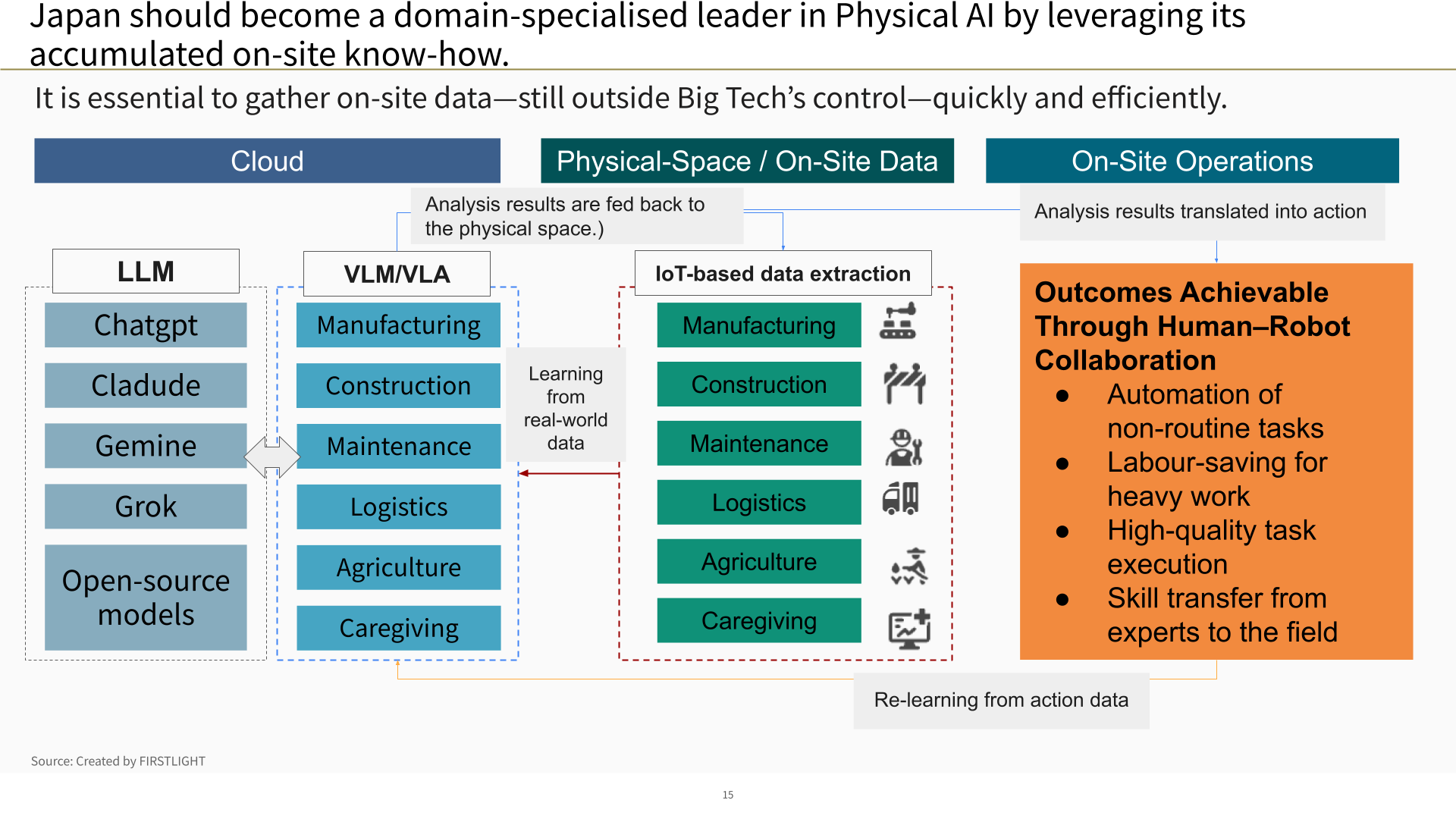

The direction Japan should pursue is to establish a data‑circulation architecture: collect real‑world data on site via IoT and edge devices, and leverage advanced AI technologies such as VLMs and LLMs in the cloud.

Collect on‑site data via IoT/edge → train VLMs/LLMs in the cloud → feed results back to the site. With no global giants yet in this space, Japan’s industries have the potential to carve out a unique position of their own.

Should start‑ups that adopt this framework emerge within each industry vertical, domain‑specialized unicorns could very well be born.

Japan, as a “problem‑advanced nation,” also boasts high social acceptance for site redesign and automation, providing a fertile ground of “tolerance and demand.”

To realize this structure, the industry as a whole must undertake the following initiatives:

- Strategic sharing of on‑site data — Raise the AI level of the entire industry.

- Cross‑disciplinary talent development spanning hardware and software.

- Creation of adoption opportunities through government joint procurement.

- Simultaneous progression of research and implementation.

Japan should differentiate not by “volume and speed” but by domain depth. Manufacturing, construction, infrastructure maintenance, logistics, healthcare—Japan’s strong sites hide vast, unorganized know‑how. Digitalizing and structuring it as AI training data would let Japan lead in areas unreachable by other nations.

This is a realm that the Big Tech companies and big‑data models of the United States and China still find difficult to reach, and one where Japan can chart its own course and lead the world.

A Physical AI Strategy to Avoid Repeating the Digital Defeat

Competing globally in vertical AI exceeds the capacity of any single firm; enormous real‑world data is indispensable. Japanese companies must share data and knowledge at the industry level to build a “One‑Team Japan” framework.

In semiconductors, a balance of “competition and cooperation” is already functioning—sharing certain data while retaining core know‑how. Physical AI likewise requires industry‑specific joint development of specialized AI under clear boundaries.

Japan has pioneers like Honda and Kawasaki Heavy Industries that developed robotics early. Commercialization once stalled due to immature AI, but today related technologies have advanced, and society is ready.

Now is the perfect time for Japan to lead the world once more. Missing this window could repeat the “digital defeat”. Determination and action to redesign industrial structures are demanded now.

At Firstlight Capital, we share this sense of urgency and future potential, and we are determined to fully support start‑ups taking on the new frontier of Physical AI.

As stakeholders betting on the future of Japanese industry, we firmly believe our support will help open a “Japan‑originated future.”

Written by Chiamin Lai | Managing Partner, Firstlight Capital

Edited by Akio Hayafune | Chief Analyst, Firstlight Capital

2025.06.30

Here at FIRSTLIGHT Capital, we regularly deliver useful content on both Japanese and global startup trends, as well as hands-on experience from our very own venture capitalists and specialists. Please feel free to contact us via the CONTACT page if you would like to be in touch. Click here to follow FIRSTLIGHT Capital’s SNS account!