A list of “Don’ts” when building SaaS: Lessons learnt from engaging with 200 startups

2022.02.21

Ever since we established FIRSTLIGHT Capital, Inc. in 2018, we have had the opportunity to meet with more than 200 SaaS entrepreneurs.

Each and every company has in themselves the seeds for success – and sometimes we do see unexpected growth as their work bears fruit. However, at the same time we can identify commonalities amongst those who did not make it, because of ‘traps’ that are easy to fall into while launching their SaaS products.

I have observed the same problems from founders pop up time and again, just like the mistakes I myself had made when I was launching products during my time with Uzabase – and I believe it is timely to compile them here.

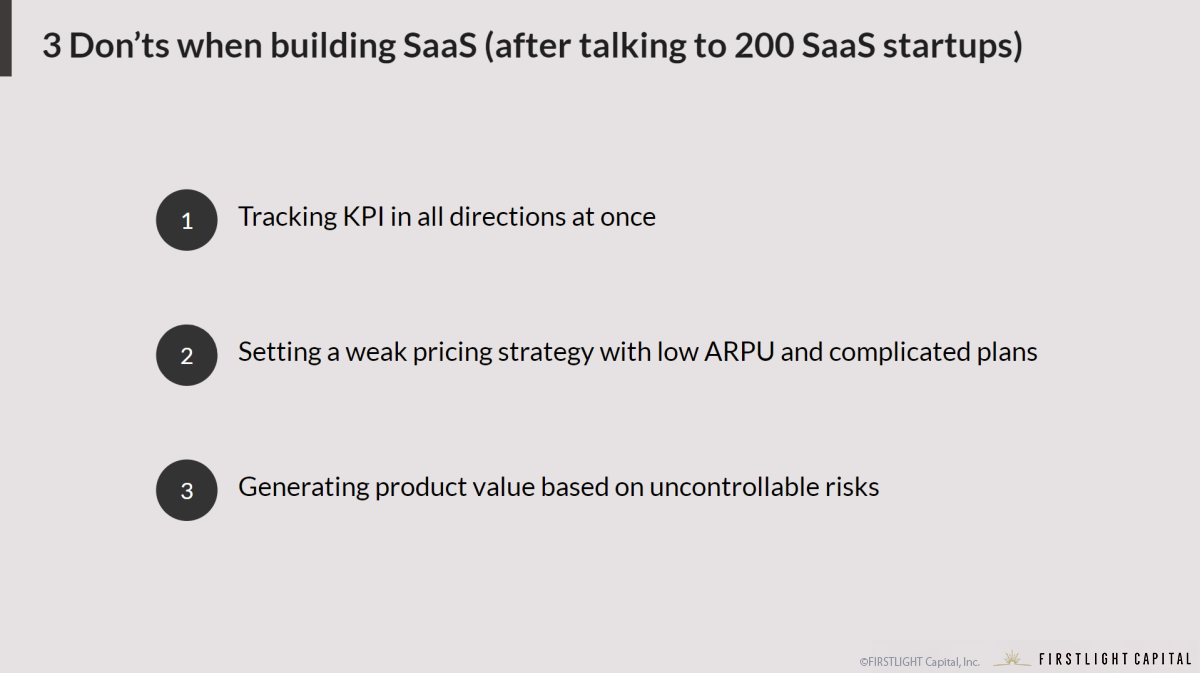

1) Tracking SaaS KPIs in all directions at once

Compared to a few years ago, the concept of SaaS KPIs has become more commonplace, with many founders understanding operational metrics such as MRR (Monthly Recurring Revenue), Churn, NRR (Net Revenue Retention), and Sales Efficiency.

As SaaS startups continue to evolve, I have had more opportunities to discuss metrics during interviews with potential portfolio companies. Nonetheless, I recognized that it is also important to not mindlessly chase SaaS KPIs in all directions. With all of these various KPIs, it is practically challenging to allocate resources to track them all simultaneously to support decision-making. In the pursuit of KPI tracking, sometimes the ‘why’ behind these KPIs are neglected for simply getting the numerical value available.

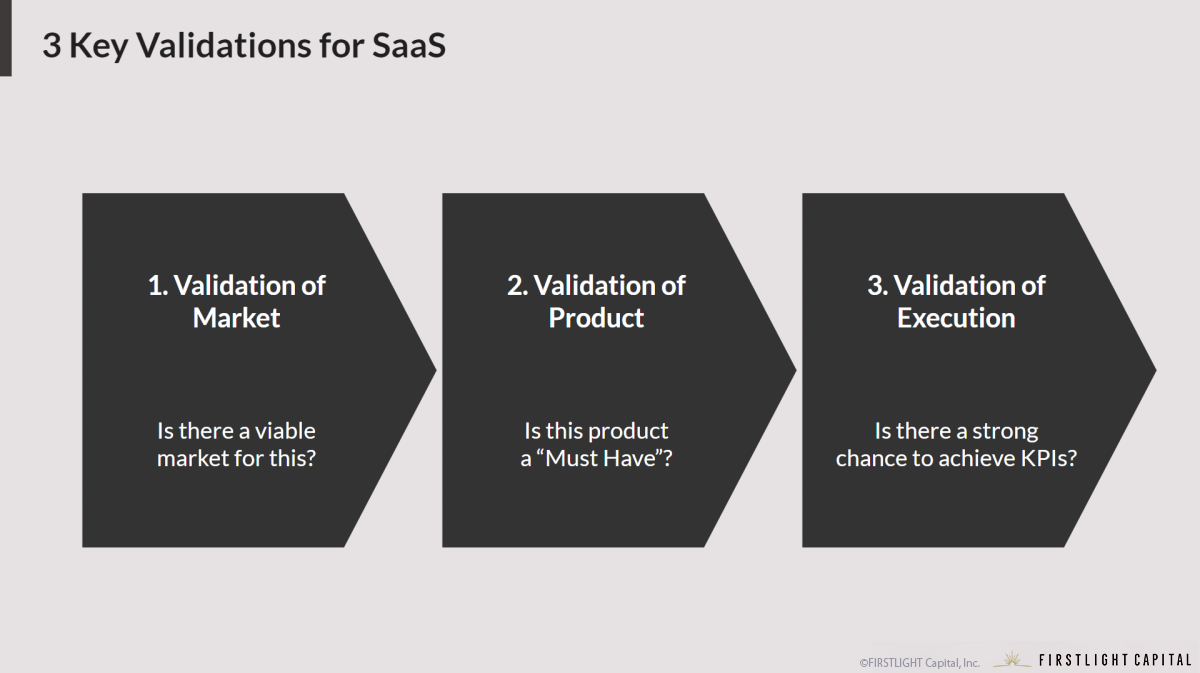

So, what kind of KPI should we then focus on? For SaaS startups, we focus on 3 key validations, namely ‘market’, ‘product’, and ‘execution’, in order to assess the startup’s growth potential.

MRR Velocity, or the speed at which MRR is accumulated, is a good example for an indication that validates ‘execution’, and is best measured after PMF (Product Market Fit). Even though it is not a general SaaS KPI, it is nonetheless an indispensable metric for determining future growth potential. When I talk to startups, many of them are concerned with how much MRR they need before the next round of funding, but this is a bit misleading. At seed stage, it is important to validate the ‘product’; we focus on product maturity, whether its customers are comfortable with the ARPU/ARPA i.e. assumed unit price, and whether we can deliver a product with low churn and high stickiness.

Once these points are validated, only then do we shift our focus to validate the ‘execution’, in order to emphasize the sense of urgency and awareness to concentrate on the speed of growth – this is done through monitoring data using different metrics, such as MRR Velocity.

Startups need to change the KPIs they monitor as their own companies move through different phases. Instead of looking at MRR during a less mature product, it is better to focus on first validating the product maturity before moving to validate the execution of the business.

Moreover, it is important to have a keen sense of the kinds of KPIs that you are monitoring at every stage. This sense or informed judgment allows us to prioritize the figures that matter the most, and thereby select the appropriate metrics to look at and subsequently make key decisions.

What is the right number of metrics we should be specifically looking at any point in time?

I believe that at each stage, it would be good to constantly monitor up to 3 SaaS KPIs to inform decision making processes effectively.

2) Setting a weak pricing strategy with low ARPU and complicated plans

The second type of mistakes I often see being made is attempts to sell the product at a low unit price while the product is still being developed, leading to a low ARPU. In other words, a low ARPU without a strong strategy is difficult to recover from.

In the early stage where the startup is still uncertain about how the product should be developed, they tend to set the unit price unreasonably low or at a discount, just to increase the number of paying customers. However, it is more often than not the case that low ARPUs that have been set without a subsequent pricing strategy are usually difficult to change.

While we were looking at the 200 SaaS startups, there was a general tendency that ARPU gradually would gravitate towards the cheapest plan when there are custom configurations tailored for each customer. In order to promote and introduce the use of a product, even when we offer an initial discount to specific customers, with the aim of moving it back to a regular contract later, the communication cost with this customer becomes relatively high, so multiple pricing revisions is not highly recommended as well.

Additionally, there are also a large number of contract plans that mix together various contract periods and paid trials. At the end of the day, too much variety of contract plans increases the burden of managing all the plans, and causes churn control to be virtually impossible. This is because more action is required to maintain retention in response to irregular changes in customer status, with the burden being borne on sales and customer success teams rising over time.

Complex pricing for each customer is ultimately ineffective in the long term, so it is important to prepare the pricing in a simple and easy to manage manner.

3) Generating product value based on uncontrollable risks

A third mistake that we often notice is that there are uncontrollable risks associated with the product value due to possible dependencies on external factors.

Particular care should be taken when the intrinsic product value is derived from its role as a data aggregator from other sources. If the core data and associated functions of the product depend on an external supplier or platform, this might mean that there are risks of sudden changes in specifications and data delivery suspension, which cannot be immediately rectified by ourselves.

Some examples would be startups that are SNS data-mining services that extract and analyze data by using other tools like marketing or Salesforce automations. The risk is especially high if the data source is a big platform company like GAFA.

In fact, Uzabase’s original business, SPEEDA, also faced this similar issue. SPEEDA is a SaaS that provides an online platform where users can download data which we aggregate and clean up from other data suppliers. However, in 2008, there were particular issues involved in our partnership with the data suppliers, resulting in difficulties in launching the product.

In that case, we were able to recover from this crisis by negotiating another contract with another data supplier – but through this experience we learned that there are sizable risks when depending on other companies to deliver your own product at an early stage.

Because of this, we began reducing the percentage of the value we provide through our data services with external vendors, by working on creating original reports and in-house production of data by our own analysts.

This is not an absolute “Don’t”, but it would be prudent to be aware of such risks that may exist, so as to ensure that your business is prepared and well-hedged to protect yourself in the face of such uncontrollable risks to your product value.

Ever since we started increasing the frequency of our publishing activities relating to SaaS KPIs, we have also similarly been getting more attention from people who may have believed that FIRSTLIGHT focuses on KPIs.

However, we believe that ultimately any type of metric is only one of many signs of whether or not a business may or may not be good.

“In order to achieve a JPY 10m MRR in a year, we need an ARPU of JPY 100k/mth; with 100 companies contracted annually; this would require a sales team of 2 people that closes 8 contracts a month.”

Such metrics are derived from the tangible experience of running and understanding the business. With the abundance of information on SaaS KPIs now available, we would like to continue to support the growth of businesses while at the same not being unnecessarily concerned about too many metrics, and only focus on what users value the most.

By Osamu Iwasawa | FIRSTLIGHT Capital, Inc. CEO and Managing Partner

Translation by Jorel Chan | FIRSTLIGHT Capital, Inc. Associate

2022.02.22

Here at FIRSTLIGHT Capital, we regularly deliver useful content on both Japanese and global startup trends, as well as hands-on experience from our very own venture capitalists and specialists. Please feel free to contact us via the CONTACT page if you would like to be in touch. Click here to follow FIRSTLIGHT Capital’s SNS account!